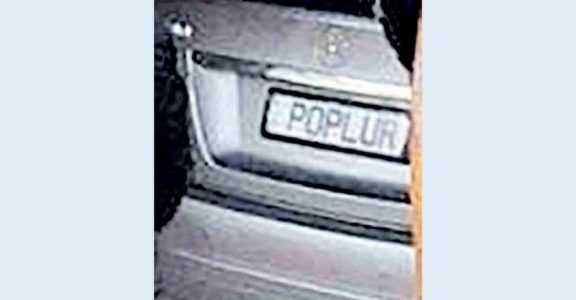

Owners of Kerala-based finance firm Popular Finance, which is at the centre of a multi-crore fraud, had allegedly found ways to circumvent the law.

A new firm was started under the Popular Finance brand every four months. Most of these were shell companies. This shady practice was started after Dr Rinu Mariyam took over the company from her father Thomas Daniel.

The owners claimed that the new firms were started to safeguard the deposits and to adhere to the legal norms of the country. The police have so far collected details of 21 companies.

The branches were given instructions on which companies' name the deposits should be received at the start of the month.

Countless firms

The deposits were accepted in the name of San Popular Finance Ltd, Popular Traders, Popular Dealers, MRPN scheme that doubled the deposits in seven years, San Popular Bond that doubled the deposits in five years, My Popular Marine, Mary Rani Nidhi Ltd, San Popular e-compliance, San Popular Business Solution, San Fuels, Popular Exporters, Popular Printers, Vakayar Lab, and Popular Supermarket.

As per law, Popular Finance cannot accept deposits from more than 200 customers. When they cross this limit, they start a new firm. The deposit certificate will bear the signature of Thomas Daniel (Roy) or that of his daughter Rinu Mariyam. This was the only guarantee that the customers had.

Where is the money?

Over 200 cases were filed by various depositors against Popular Finance, headquartered in Pathanamthitta district. And investors have alleged fraud of over Rs 2,000 crore.

However, Popular Finance owners are yet to reveal if they had invested in any major enterprise. The only loss they claim was suffered during the lockdown days. However, it is hard to believe that a finance firm, which has been in existence for more than five decades, will collapse due to a few months of lockdown. The police suspect that the money was diverted to other ventures in a clearly planned move.

The Australia link

The owners link to Australia and alleged investments in that country are also under the scanner. Suspicion arose after company chairperson Marykutty Daniel left for Australia. Marykutty lives with her daughter in Australia. Daniel’s daughters, Dr Rinu and Dr Riya were also trying to flee to Australia when they were nabbed from the Delhi airport last week.

An investigation will be held into their investments in Australia with the help of central agencies.

Daniel and another relative own luxury cars in Melbourne. However, Popular group does not have any branch in Australia.

Staff left in the lurch

After Dr Rinu took over the reins of the company, annual targets were given for all employees starting from attender to the manager. The lowest target set for branches was Rs 2 crore. The staff had amassed deposits of crores of rupees. The staff deposited their own money, and that of their kin, friends and relatives to achieve this target. After the firm collapsed, these staffs have been left in the lurch.

The money of bed-ridden patients and those people who had been saving up for their daughter's wedding were deposited at these branches.