New Delhi: Reaching out to a large electorate ahead of the Lok Sabha polls, the Narendra Modi government Friday announced a cash dole for small farmers, a mega pension scheme for the unorganised sector and doubled the threshold tax exemption limit to Rs 5 lakh.

Presenting the interim 2019-20 Union budget in Parliament, Finance Minister Piyush Goyal said Rs 6,000 per year cash support will be given to small and marginal farmers that will cost the exchequer Rs 75,000 crore annually, in a bid to provide relief to distressed farm sector.

Under the scheme called 'Pradhan Mantri Kisan Samman Nidhi', Rs 6,000 will be transferred into bank accounts of farmers holding up to 2 hectares of land in three equal instalments.

Goyal said it will benefit 12 crore farmers and will be implemented from this fiscal itself.

He said Rs 20,000 crore have been provided for current fiscal and also announced allocation of Rs 75,000 crore for the next fiscal.

Unveiling the mega pension yojna for the unorganised sector workers that will benefit 10 crore people, Goyal said they will get assured monthly pension of Rs 3,000 after reaching the age of 60 years.

"We are launching Pradhan Mantri Shram Yogi Mandhan today. The scheme will provide assured monthly pension of Rs 3,000, with contribution of 100 rupees per month, for workers in unorganised sector after 60 years of age," Goyal said.

Goyal, who is standing in for Arun Jaitley undergoing treatment in the US, informed the House that the government will also provide a matching contribution of Rs 100 for every unorganised worker covered under the scheme.

"The scheme will benefit 10 crore workers in unorganised sector, may become the world's biggest pension scheme for unorganised sector in five years".

Tax bonanza

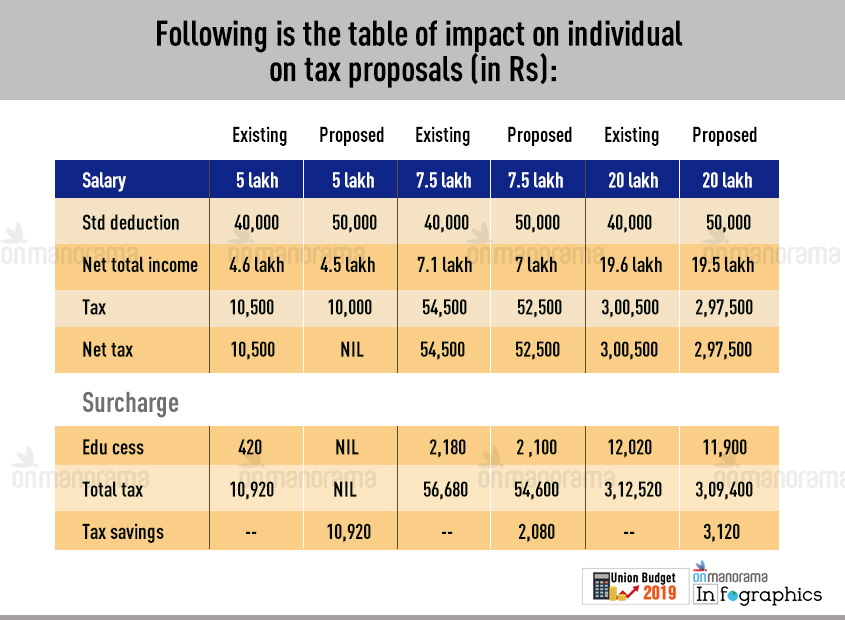

In a major relief for the middle class, Goyal proposed to double the threshold tax exemption limit to Rs 5 lakh and increased the standard deduction from the existing Rs 40,000 to Rs 50,000.

The announcement was greeted with thumping of desks by PM Modi and members of the treasury benches.

The proposal will benefit 3 crore middle class tax payers, Goyal said.

Doubling the threshold exemption limit is expected to cost the exchequer Rs 18,500 crore.

Goyal further said an individual having an income of Rs 6.5 lakh per annum will not be required to pay any tax provided he invests in the specified tax saving schemes of the government.

The TDS threshold on interest from bank, post office deposits was also raised from Rs 10,000 to Rs 40,000.

"This is not just an Interim Budget, this is a vehicle for the developmental transformation of the nation," Goyal said.

He also announced a hike in the defence budget to over Rs 3 lakh crore.

Rashtriya Kamdhenu Aayog

He said 10 lakh patients have been treated so far under Ayushman Bharat scheme, the world's largest health care programme. The scheme was launched to provide medical care to nearly 50 crore people, resulting in savings of Rs 3,000 crore for poor families.

Goyal also announced a new AIIMs, the 22nd in the country, in Haryana. He said currently 21 AIIMs are operating or being established in the country, of which 14 have been announced since 2014.

The government announced setting up of Rashtriya Kamdhenu Aayog to enhance productivity of cows. It provided for 2 per cent interest subvention to farmers involved in animal husbandry and fishery.

Goyal said the government has provided for 10 per cent reservation to the economically weaker section in educational institutions and the government jobs. This has been done without disturbing existing reservation system.

He said India attracted $ 239bn in FDI in last five years.

Key points

• Goyal announced a Rs 64,587 crore outlay for Indian Railways for the next financial year. He also set an operating ratio of around 95% for the public transporter.

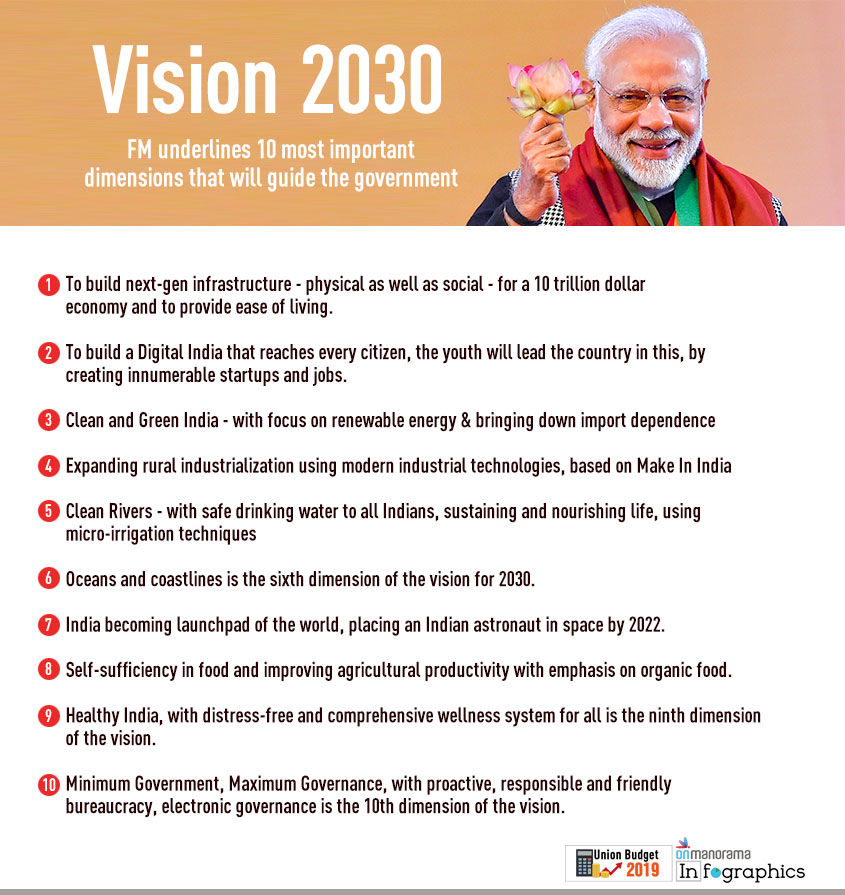

• Vision 2030: India will lead the world with electric vehicles and energy storing devices

• India poised to become a $5 trillion economy in the next 5 years, aspires to become a $10 trillion economy in the next 8 years

• TDS threshold on interest on bank and post office deposits raised from Rs 10,000 to Rs Rs 40,000

• TDS threshold on rental income raised from Rs 1.8 lakh to Rs 2.4 lakh

• Standard deduction increased to Rs 50,000 from Rs 40,000

• Individuals with annual income up to Rs 5 lakh exempted from income tax - Rs 13,8000cr benefit for three crore tax payers

• Will reduce GST burden on home buyers. Only 12% GST for cinemagoers

• 18% increase in direct tax collections in 2017-18, 1.06 crore people included in the tax base. Also, more than 1 crore people filed IT returns for the first time, after demonetisation

• 6 cr free LPG connections provided under Ujjwala yojana

• A single-window clearance for filmmaking to be made available to filmmakers, anti-camcording provision to also to be introduced to Cinematography Act to fight piracy

• India's defence budget enhanced beyond Rs3 lakh cr

• Vande Bharat Express will provide speed, service and safety to citizens and will boost Make In India

• Railways capital expenditure increased. All unmanned crossings on broad gauge network eliminated

• Mega pension scheme Pradhan Mantri Shram Yogi Mandhan (PMSYM) to be launched to support workers in unorganised sector. PMSYM assures monthly pension of Rs 3,000 per month, with contribution of Rs 100 per month.

• Gratuity limit increased from Rs10 lakh to Rs30 lakh

• Rs 75,000 crore allocated for for PM Kisan Yojana, which would benefit 12cr farmers

• Indian farmers' income will double by 2022

• Small and marginal farmers to benefit from PM Kisan Yojana, Rs 6,000 per year for each farmer

• Rs19000cr allocated for rural roads; Rs60,000cr being allocated for MNREGA

• As a tribute to Mahatma Gandhi, world's largest behavioural change movement Swachh Bharat initiated; more than 98% rural sanitation coverage has been achieved; more than 5.45 lakh villages declared ODF: FM

• Almost Rs 3 lakh crore has already been recovered in favour of banks and creditors, big defaulters have also not been spared by our government: FM

• Inflation is a hidden and unfair tax; from 10.1% during 2009-14, we have broken the back of back-breaking inflation: FM

• I can confidently say, India is solidly back on track and marching towards growth and prosperity: FM

• Narendra Modi government's sixth & final budget ahead of LS polls

• Sensex, Nifty steady ahead of budget presentation

• The budget will seek Parliament's nod for spending for four months till a new government is sworn-in

• The interim budget likely to contain tax sops and a certain package for the farm sector

• It was speculated that the budget presentation on February 1 will be just like a full-fledged one with sops and announcements to woo voters

• Congress had said it will strongly oppose, both inside and outside Parliament, the presentation of a 'full budget' by the BJP-led NDA government as it has 'no electoral legitimacy' and the step will go against set precedents and Parliamentary traditions.

• Manish Tewari of Congress: Since morning, govt sources have been sending budget pointers to media houses, now if these pointers are there in FM's speech then it tantamounts to a leak. It would be a serious issue of breach of secrecy

New Delhi: The Narendra Modi-led government poured extra money into support for farmers and a rural jobs programme, delivering on Friday its last budget before Lok Sabha due by May with the clear aim of winning over votes.

Modi's ruling alliance is facing discontent over depressed farm incomes and doubts over whether his policies are creating enough jobs.

The interim budget for 2019-20 allocated Rs 600 billion for a rural jobs programme and 190 billion for building of roads in the countryside.

The fiscal deficit in 2018/19 would be 3.4 per cent of gross domestic product (GDP), slightly higher than the targeted 3.3 per cent, Finance Minister Piyush Goyal told the Lok Sabha.

Goyal was standing in for Finance Minister Arun Jaitley, who was undergoing medical treatment in the United States.

The deficit was widely expected to be higher than targeted due to a combination of revenue shortfalls and increased spending ahead of the election.

The benchmark 10-year bond yield fell 3 basis points to 7.46 per cent once the new fiscal deficit estimate was revealed as investors showed relief that it wasn't worse.

"India is solidly back on track and marching towards growth and prosperity," Goyal said as Modi and BJP MPs thumped their desks in appreciation.

A report in a national daily the previous day belied the government bullishness over the economy.

It reported that the government has been withholding an official survey that showed India's unemployment rate at its highest in decades.

Read more: Latest Union budget news

.jpg.transform/170x160/image.jpg)