Kannur: Kerala is a den of gold smuggling even if only the reported cases are considered. The reported cases are a tip of the iceberg though.

Gold smuggling has several motivations apart from the obvious factor of tax evasion. Gold can be bought cheaper than in Kerala in several places. Gold smuggling is also a useful means of money laundering.

Gold smugglers go to any length to sneak in the contraband. Why do they risk so much? What do they gain which legitimate traders do not?

Rs 4 lakh profit per kilogram

A kilogram of gold is priced at about Rs 33.6 lakh, after tax. When the same quantity is smuggled in, the operatives make a neat profit of more than Rs 4 lakh. The import duty on gold and silver was cut from 12.5 per cent to 7.5 per cent in the previous Union budget. That move was widely expected to cut down on smuggling but that has not happened yet.

The effective import duty rate on gold is around 10.75 per cent, including 2.5 per cent agricultural cess and 0.75 per cent social welfare surcharge. On top of that, a 3 per cent Goods and Services Tax makes it more expensive.

Smuggling continued unabated even when the tax rate on gold was 10 per cent. In fact, minor tax rate variations have no impact on gold smuggling because the clandestine activity is closely related to hawala transactions between India and the Gulf countries. Gold smuggling is an important method of illegal cross-border money transactions.

Gold smugglers are assured of a cut in the transaction apart from the Rs 4 lakh profit per kilogram of the metal.

When the price for 24-karat gold was priced at around Rs 47 lakh, taxes hovered around Rs 7 lakh, at the rate of 12.5 per cent import duty, excluding 3 per cent of Goods and Service tax. When the price fell to Rs 33.6 lakh and the tax rate came down to 10.75 percent, smugglers ended up increasing their profit to Rs 4 lakh per kilogram.

Eclipsing imports

India imports 800 to 1000 tons of gold ever year. Gold smuggled into the country would easily eclipse this quantity. Smugglers choose a variety of routes, including airports, maritime routes and land borders. Except random busts at the airports, all those activities go under the radar. Maritime smuggling is hard to contain.

Smugglers often get tacit support from the very officials who are supposed to prevent them. Most of the busts at the airports are planned by the smugglers themselves, so that the other carriers can get away with the contraband. Each flight would be carrying more than one carrier and one of them is made a scapegoat sometimes. Even the carriers who are busted can walk away with the gold after paying taxes and fines.

Kerala has about 12,000 gold traders with GST registration. Among them, they have an annual turnover of about Rs 30,000 crore. The unorganised sector dealing in gold is estimated to be valued at about Rs 2 lakh crore. They are untouched by the official watchdogs, associations of legitimate gold merchants alleged. A proposal to reduce the import duty to 2 per cent is mooted to take away the incentive for smuggling.

Tax loss

Since the gold import is eclipsed by the amount of the smuggled contraband, the government suffers a huge dent in its tax revenue. Import duty was increased from 2 per cent in 2004 to 10 per cent with an eye to increase tax revenue. In reality, higher tax prompted more smuggling. If taxes come down, so will the gold price and the incidence of smuggling.

Union Finance Minister Nirmala Sitharaman said the budget was intended to bring down the prices of gold and silver from the spike caused by an increase of import duty to 12.5 per cent in 2019. She also said that the Securities and Exchange Board of India (SEBI) will be asked to regulate gold trading as well.

Consumers have the power to curb gold smuggling. They can make a difference if they make sure that they buy only from recognised sources. Consumers are being duped when they buy smuggled gold. Both sellers and buyers should be vigilant against this pitfall. Jewellery shop owners have a legal duty to ensure that customers are only sold legitimate gold.

Consumers who bought illegitimate gold may be in for a shock when they try to resell it. Legitimate gold can be stored, transported and transacted with peace of mind for any length of time.

Metal that hurts

Gold mining and distribution are governed by international protocols. These guidelines have to be complied with from the stage of ore mining to the final point of sale. Gold mining, refining and distribution should not lead to environmental degradation, child labour and inhuman work conditions.

Mining should not affect the ecosystems of indigenous populations. Everyone involved in the mining sector should be assured of fair wages. Gold mining should not thrive on exploitation of poverty. The process should be free of sexual exploitation and human rights violations. Also important is the compliance to all legal norms, including tax payments.

Many of the major gold mines are situated in African countries. Many of those mines are owned by people from outside the continent. Most gold mines are owned and operated by Europeans. They transport huge quantities of gold to Dubai through agents and make a killing by selling it. Dubai is a preferred destination for its free market reputation.

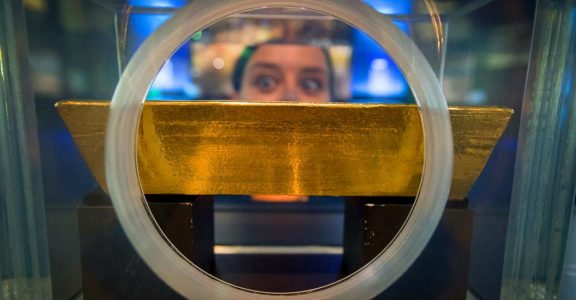

The gold that reaches Dubai is passed on to the refiners in the United Arab Emirates. The yellow metal assumes different shapes in those refineries, including the better known 116-gram bars. Dubai imposes no restrictions on gold transactions. Anyone can buy any quantity of gold in the emirate without getting any eyebrows raised.

Gold is cheaper in Dubai than in India. That gold is sneaked into India. The money transacted through hawala agents is used to buy up gold and then to smuggle it into Kerala. When India charges more than 10 per cent import duty on gold, that tax is saved through smuggling. Smugglers are assured of a basic profit of 10 per cent. Carriers are given a fixed percentage of commission.

A crackdown by the Dubai government has lessened the magnitude of gold smuggling.

GST evasion

The GST intelligence often seizes gold that is sold without paying taxes. This undocumented gold is actually contraband. The GST intelligence collects a fine from the parties and shares the information with the customs department. Even north Indian agents are active in Kerala, smuggling gold to the jewelleries of the state.

Strangely, evading a 3 per cent GST is not the only motivation for smuggling. Both traders and unscrupulous customers use gold smuggling for money laundering. The GST department does not have the power to nab gold smugglers. However, the tax department is authorised to trace the gold smuggled into Kerala. They have to track the contraband and the value-added products it has led to.

200 tons of gold

According to some estimates, as much as 200 tons of gold is smuggled into India every year. This is a huge jump from an average of 80 tons just three years ago. Smuggling skyrocketed after the import duty was increased from 10 per cent to 12.5 per cent. Curiously, a decrease of import duty to 10.75 per cent has not led to a corresponding decrease in smuggling.

According to official estimates, only 800 tons of gold is imported to India every year. Yet at least 1,000 tons of gold is added to the market every year.

A study conducted by Canada-based Impact showed that most of the smuggled gold in India has its origin in Africa or South America. They are sneaked in through Gulf countries, Myanmar or Kazakhstan. A third of the illegally trafficked gold worldwide passes through India, according to the report.

Safe haven

The spike in gold prices is another crucial reason for the increase in smuggling. Gold prices shot through the roof last year. Gold price rose from Rs 29,000 per sovereign on January 1, 2020 to Rs 42,000 per sovereign in August.

Though the price decreased since then, it hovers around Rs 35,000. Gold is becoming pricier as a safe haven investment. This thought intensified in the uncertain times of COVID-19. Demonetisation was another factor that triggered the stockpiling of gold. Stock market volatility also leads to an increased demand of gold.

Bands of smugglers are involved in using the contraband as a money laundering method. Middlemen buy gold cheaply from the sources in Africa. They fund the transactions using hawala money. Whoever wants to launder black money has to hand it over to a middleman in India. They will get gold equivalent to the amount, after the agents take their cut.

It is not only tax evasion that drives gold smuggling. The untaxed gold is actually sold at a price higher than taxed gold. Who buys it? Tax evaders who have secret caches of money to launder. Storing black money as currency notes is no longer viable after demonetisation. They have to furnish identification papers such as Aadhaar and PAN to invest in gold or to buy it.

Smuggled gold comes with no such riders. That is the reason gold is a safe haven for smugglers and tax evaders too.