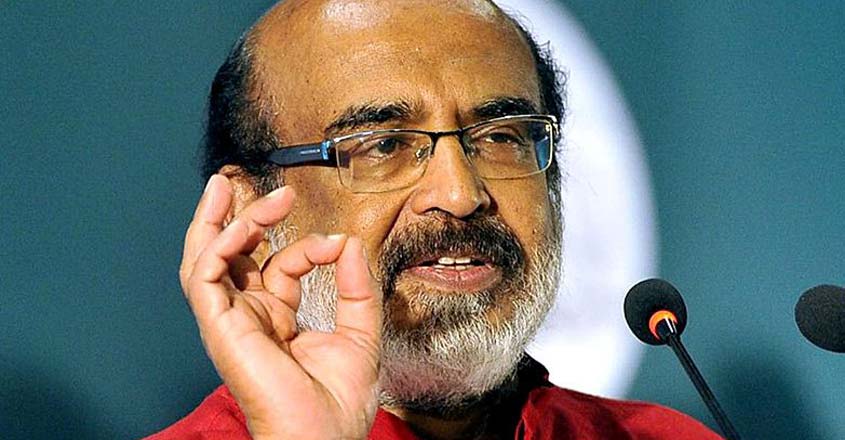

Finance Minister T M Thomas Isaac's ambition of providing a post-flood vision for the state suffered a huge jolt at the GST Council meeting on January 10.

Of course, the GST Council had bowed to Isaac's major demand. He has been allowed to impose a one per cent calamity cess in addition to GST on goods and services provided within the state. However, the decision to push up the GST exemption limit for traders from an annual turnover of Rs 20 lakh to Rs 40 lakh will badly bleed a state already made financially pale by the August floods.

Unofficial figures put the loss at Rs 300 crore. However, the finance minister's office said an assessment has not yet been done. Still, the office reckons it would be around Rs 250 crore. For a state struggling to find funds for reconstruction activities, every crore counts. (At the national level, the official estimate is that the loss would be Rs 5200 crore.)

According to official figures, 2.5 lakh traders have taken GST registration in the state. At least 1.2 lakh of them have a turnover of less than Rs 40 lakh per annum. They will come out of the tax net with retrospective effect, from April 1.

The GST Department's hope of bringing more traders within the tax net has also suffered. The data collected by the Department of Economics and Statistics shows that there are 13.24 lakh units in the non-agricultural field existing outside the tax radar. The highest is in the manufacturing sector, nearly 4.9 lakh. Retail traders outside the tax radar total 6.18 lakh. Restaurants and hotels unnoticed by the tax system are 97,826. Even vehicle workshops not paying tax number a whopping 37,510 units.

Though the higher exemption limit will lead to revenue loss, it will not necessarily mean that many traders will happily drop out of the tax net. The GST mechanism is so devised that many a trader will not find it profitable to quit the tax regimen. A trader can claim input tax credit only if he has GST registration. (Input tax credit is essentially the reimbursement of the tax that has already been paid for a component that has been used as one of the ingredients in the making of a product.)

Also, large manufacturers will put pressure on small traders to opt for registration. “These big manufacturers will say that they will accept their goods only if the company has GST registration,” said Prof Jose Sebastian of Gulati Institute of Finance and Taxation. Banks, too, insist on GST registration as a prerequisite for providing loans, leaving small traders will little choice.

There are also disadvantages if the trader registers. “He will have to file his annual returns, and has to maintain his records properly. There will always be the threat of official persecution,” Sebastian said. So, opting out of the GST network will be based on a cost-benefit analysis. “If a small supplier can strike a win-win deal with a buyer, then he need not bother to have a GST registration,” he added.