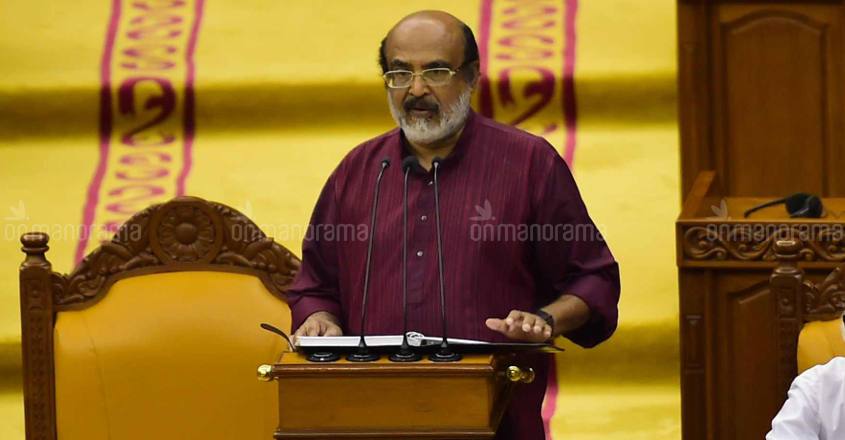

When Finance Minister Thomas Isaac presents the Budget on January 31, he will do it in the most unusual of circumstances. Along with roads, bridges and agricultural lands, the August deluge had made useless even the theories of welfare and economics that Isaac normally banked on.

It is estimated that over Rs 30,000 crore, an amount far bigger than the state's annual plan outlay, is needed to reconstruct the state. Meaning, planned economic growth will have to wait. It could have been attempted had it been a normal 2018. Now, the only thing for Isaac to do is start from scratch.

Given this unique challenge, Onmanorama asked reputed economists in the state to recommend the two most important issues they feel Thomas Isaac should address in his post-flood Budget.

M A Oommen: Honorary fellow, Centre for Development Studies, and state's foremost expert on decentralisation

Transparency guarantee

It is desirable to present a White Paper that will bring out in detail the sources and uses of funds in the Recovery and Rebuilding Project. All off budget items and how they gel with the whole financial schemes is a worthwhile effort that will add to public trust and transparency. The Post Disaster Needs Assessment of the UN had estimated that the recovery required Rs 31,000 crore, or Rs 6200 crore a year over the next five years at 2018-19 prices. And even if we allow some margin for beneficiary contribution and private sector contribution, Rs 4030 crore would be needed per annum. For the Budget year 2019-2020, allowing for a 5 per cent inflation, will work out to Rs 4321 crore. This is easily within the resource potential of the state provided the solidarity of the public, including the diaspora, is also mobilised and managed.

Where has the income gone?

The finance minister should make an honest self-evaluation of what happened at least during the last seven fiscal years and answer the innumerable questions that arise. Constructive reform options can come only in this manner.

Medium-term fiscal policy targets, for instance, are seldom achieved. Also, there is heavy loss of tax revenue on account of evasion and avoidance. In the gold sector alone, it is estimated that transactions worth Rs 2900 crore were outside the tax net. Presumably, the government loses Rs 15,000-20,000 crore as tax revenue yearly as a result of poor tax administration. The continued increase of interest payments and pension payments since 2009-10 is also a matter of serious concern. State governments resource mobilization will have to be stepped up.

Official figures show that the state has a debt stock of Rs 2.37 lakh crore, which itself comes to 30 per cent of the GSDP and therefore substantially more than the 20 per cent cap prescribed by the FRBM review committee.

It should also be assessed whether the demands for grants are placed before the Assembly after thorough evaluation. Under utilisation of budgetary funds is rampant. The utilisation of funds by State Disaster Management Authority is a classic case of under-performance. From April 2012 to March 2017, the SDMA has utilised just 43 per cent of funds allotted to it. This might have had some bearing on the efficiency of the state's response to the August floods.

At any rate the savings in budgetary allocations must be subject to scrutiny. We need explicit transparency guarantees to avoid corruption and leakages. Why there is slippage in mid-term fiscal plan should be starting point of any self-evaluation by the finance minister.

Jose Sebastian: Tax expert, Gulati Institute of Finance and Taxation

Stop the hand-holding

It is a big misconception that there is no scope for additional resource mobilisation. In fact, there is. Given the context of a severe resource crunch, and especially when the state is desperate for funds to rebuild a flood-ravaged state, it is only natural to expect the finance minister to try hard to find more revenue sources.

For one, he could take over the administration of the property taxes from the local bodies through a tax rental arrangement. Also, this tax can be raised without much trouble. Property tax, which is a recurring tax levied by grama panchayats and urban local bodies on buildings and constitutes more than 50 per cent of the total tax revenue of local bodies, has not been touched for almost two decades. The state taking over the property tax will make the tax collection more effective, and the local bodies can be adequately compensated. The generous subsidies that have been in place in the health and education sectors can also be pared down.

Put more money in the hands of poor

Welfare pensions for the financially distressed should be raised substantially. It should be enhanced to at least Rs 5,000. The best way to increase consumption, and thereby tax revenue, is to put more money in the hands of the needy sections. The poor do not have the luxury of savings like the rich, they will have no choice but to spend the money on basic needs like food and health. The rich, on the other hand, has the propensity to save. The lower income families with extra spending power will also rev up local trade and economy. The economy in general will benefit with the poorer classes having a higher purchasing power.

B A Prakash: Chairman, State Finance Commission

Splurge cannot go on

State finances are not showing any signs of improvement. The finance minister had come out with a White Paper in 2016-17. However, the CAG reports that came later said the situation continued to worsen. Treasury restrictions have become the norm. Be it the Public Service Commission or government departments, fiscal profligacy rules the roost. Though expenditure controls have been announced, government departments have no qualms buying up costly Innova cars for even middle-level officials. Unnecessary post creation continues unabated. At a time when there is no money to pay the flood victims, there is unlimited medical reimbursement for MLAs and ex-MLAs. The upshot is uncertainty in all sectors. Fiscal correction, therefore, should be the thrust of this budget.

Reconstruction roadmap

It has been months since the floods had ravaged the state but except for the primary relief of Rs 10,000 to victims nothing much has been done. Compensation has not been given for the loss of houses, shops and agricultural lands. What this clearly shows is a glaring lack of funds. How is the finance minister going to finance the rebuilding initiative. If Kerala Infrastructure Invest Fund Board (KIIFB) is the solution the finance minister would be suggesting, then he will have to list out the achievements of KIIFB till now. A clear roadmap, whether using KIIFB or other sources, has to be laid down in the Budget. It is already too late.

Manju S Nair: Director, Centre for Agro Ecology and Public Health, and associate professor, Department of Economics, Kerala University.

Sustainable livelihood package

The Budget should have measures to ensure sustainable livelihood for those affected by the floods. For instance, the cash crop farmers in Wayanad and Idukki are in a deep crisis. Large swathes of cash crop farms had been inundated and the crops had rotten right down to the roots. That their livelihood sources have been destroyed is just one half of the problem. Even if they mange to get the money to restart all over again, it will take nearly a decade for money to come in. In Palakkad, the livestock farmers have seen most of their cattle washed away in the floods. Further south in Alappuzha, the traditional sectors, like coir and fisheries, and paddy cultivation have taken a massive hit. So the Budget should announce region-specific and sector-specific measures to sustain livelihoods.

Healing touch

There is an alarming rise in communicable and non-communicable diseases in the state. Unheard of scourges like Nipah and Monkey fever have made an entry. Even diseases that were thought to have been more or less banished, like cholera for instance, have made a dramatic return. Along with this is the exorbitant rise in treatment costs. Together, this is a catastrophe for middle- and lower-income groups in the state. A comprehensive health insurance scheme, which the government has already announced, should be rolled out without delay. The Budget should take forward the government's stress on the public health system. Primary health centres should have more doctors, nurses and equipment. It is not enough to follow the national public health standards. Kerala should go one up and adopt more advanced standards.