Thiruvananthapuram: Prices of many commodities will rise in the next financial year as an offshoot of Thomas Isaac's 10th state budget presented in assembly on Thursday.

Prices of most of the electronic equipment, construction items, automobiles and beauty products will increase.

The introduction of flood cess and hike in tax envisaged in the budget will lead to the price hike.

However, the finance minister has also announced a slew of welfare programs and infrastructure development schemes in the state, which is gradually recovering from the devastating floods.

Here is the highlights of Kerala Budget 2019:

Developmental Highlights

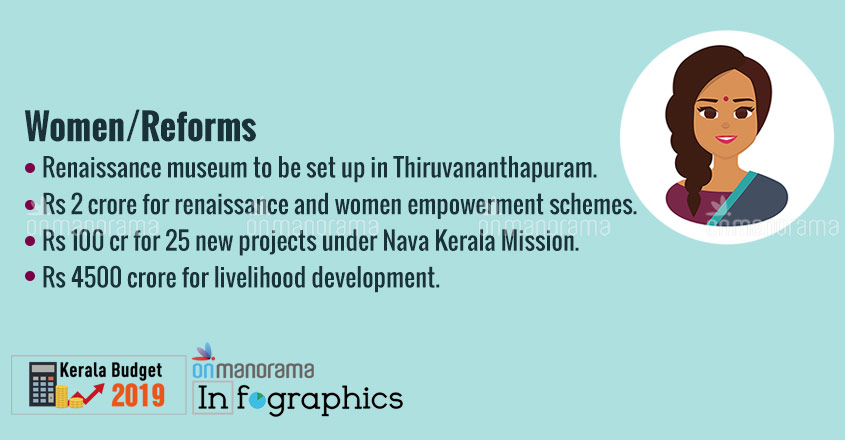

• Study centre and museum on renaissance in Thiruvananthapuram

• Rs 250 cr for flood affected panchayats

• Rs 1,000 for rebuild Kerala initiative

• Industries Park and large investments – 15,600 crore outlay

• Ring road near Vizhinjam

• Petrochemical Park at Kochi

• Land bonds and land pooling for industrial development

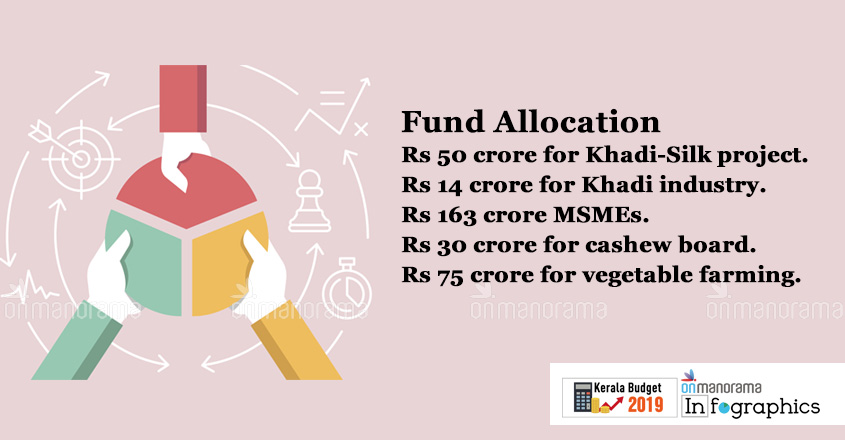

• Ayyankali Employment Guarantee Programme - Rs 75 crore

• Rs 700 crore for startups

• Branched sale of Wayanad coffee to improve earning of cultivators – introduction of new brand as 'Malabar'

• 10 crore for pepper development in Wayanad

• Carbon neutral coffee production in Wayanad

• Townships in Kochi on Amaravati model

• Keragramam scheme for coconut cultivation

• Rice park and rubber park of international standard

• Rs 500 crore for support price for rubber

• New Kuttanad Package - region to be cleaned up - Rs 500 crore

• New duck breeding farm in Kuttanad

• AC Road to be re-constructed

• Life Science Park - Rs 20 crore

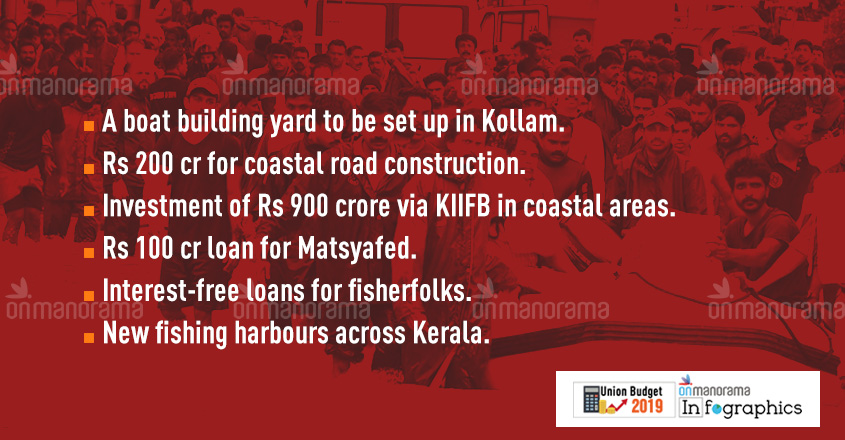

• Rs 1,000 cr to be spent for coastal areas - Ochi package to be enlarged

• Housing scheme for fishermen

• New Port at Pozhiyur

• Boat building yard at Kollam

• 20 PSUs to turn around

• Rs 900 cr for taluk hospitals

• LED bulbs for all houses through Kudumbasree

• Tax concession for electric vehicles

• Factories for building electric vehicles

• KSTRC to run TVM city buses using electric buses

• Bakel - Vizhinjam waterway to be ready by 2020

• Spices route project to be expanded

• Rs 1,367 crore for public works

• North-South parallel rail line

• NORKA to meet expenses for transport of dead bodies of Keralites from Gulf

• Kerala Bank, first scheduled bank in the cooperative sector, to start functioning in 2019

• Rs 20 crore for hunger free Kerala

• Rs 1,420 for women empowerment

• Micro industrial units under Kudumbasree for selected products

• Bank loans to 6,500 neighbourhood groups

• Life Mission third stage – Rs 1290 crore

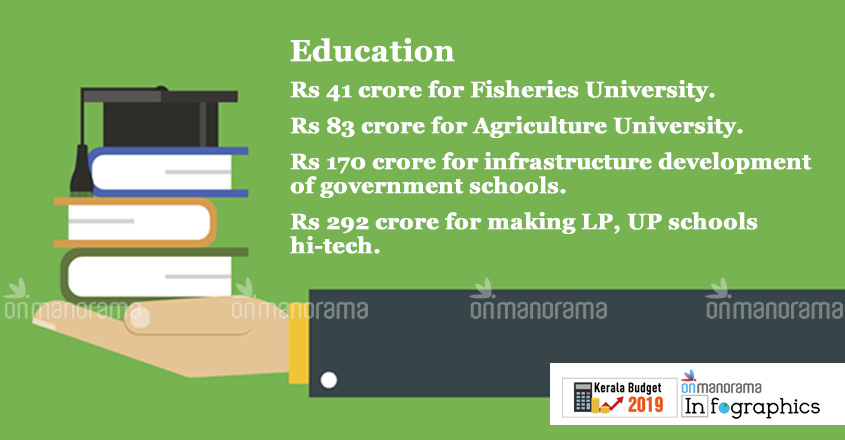

• Rs 292 crore for high tech classrooms sanctioned by KIIFB

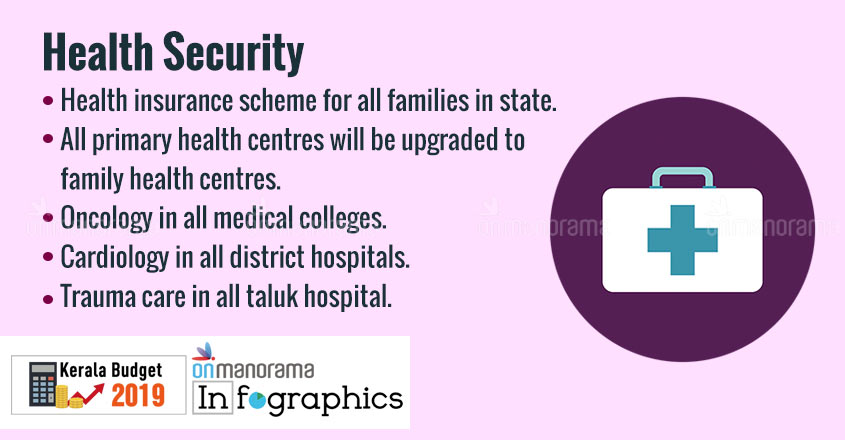

• Comprehensive Health Insurance Scheme announced - Rs 1 lakh coverage

• Government to provide assistance of up to Rs 5 lakh for those requiring costly treatment.

• Trauma care in all hospitals

• Rs 35 crore for academic excellence

• Rs 2,500 crore for agriculture

• Sports Park - Rs 7 crore

• Opening closed cashew factories - aid for loan restructuring

• Welfare pensions to be hiked by Rs 100 to Rs 1,200 a month

• 100 new BUDS schools to be started

• Rs 20 crore more for endosulfan victims

• Rs 147.5 crore schemes for Sabarimala base camps

• Rs 629 crore for roads to Sabarimala

• Rs 100 crore for Travancore Devaswom Board.

• Wayanad-Bandhipur high way - 50% of cost to be met by Kerala

• Rs 1000 crore for KSRTC

• Welfare Fund for workers of employment guarantee scheme

• Rs 91 crore for Kasaragod package

• State Finance Commission to be named shortly

• KFC to raise Rs 500 crore from market

• Pay revision arrears to be paid in two instalments in cash

Financial Proposals

• All commodities with GST rates of 12% and above to attract 1% flood cess for two years

• 0.25 per cent cess on gold, silver and platinum for two years

• Small dealers who have availed composition tax will be excluded from levy of cess.

• 2% hike in tax on first sale of beer, wine

• Local bodies allowed to collect 10% luxury tax on cinema tickets and other entertainment

• Onetime tax on new motor cycles, motor cars and private service vehicles used for private purpose increased by 1%.

• 50% concession on tax for five years to newly registered e-Rickshaws, 25% concession for other electric vehicles.

• Five per cent hike in fees and charges on government services

• Fee on appeals to Revenue Department raised to Rs 20

• Stamp duty for agreements relating to deposit of title deeds reduced from 0.50% to 0.10% with a maximum ceiling of Rs 10,000 and stamp duty for release deeds for such mortgages shall be reduced to 0.10% with an upper limit of Rs. 1000/-

• Stamp duty for agreements for the purpose of land development between the landlord and builder will be reduced to 1% from 8%, with an upper limit of Rs. 1000/-

• e-Stamping expanded and court fees included within the ambit of e-Stamping

• Maximum rate of interest chargeable by a money lender fixed at 18%.

• Revenue deficit to be reduced to 1% and fiscal deficit to 3%

• Automatic number plate detection for ensuring tax payment

• Tax Department to be restructured

• Tax Intelligence wing to be strengthened

• Compounding for service providers at 6 per cent