Thiruvananthapuram: The one per cent flood cess is set to increase the price of luxury goods. While cess is normally levied on existing tax, flood cess will be levied on the original price of the item, said sources in the GST department.

The new cess may not be applicable to consumer goods, keeping in mind imminent Lok Sabha polls.

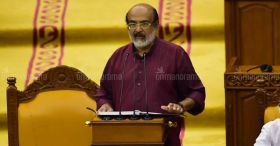

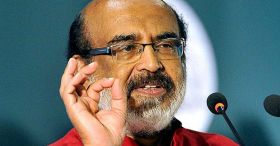

But luxury items like cars, refrigerator, TV, air conditioner, cement and cigarette could be on the list, to be announced during the State Budget on January 31 by Finance Minister TM Thomas Issac.

Since the cess will be applicable only in Kerala, the government fears tax evasion tactics involving buying products from outside the state for lesser price could be rampant again.

The government’s move to tax imported vehicles registered in Pondicherry, but used in state, had failed earlier.

The cess could apply on all products with 28 per cent GST and some with 18 per cent. Additional cess on gold, which has three per cent GST, could burden families during weddings.

The GST Council had given the state government right to levy flood cess. The cess, applicable for two years should collect no more than Rs 2,000 crore. The income from the cess need not be shared with the Central Government, unlike GST. Businesses will have to update their billing software to accommodate the cess, likely to come to effect from 1 April.

Effect of 1% cess on car, TV

• A car worth Rs 5 lakh will cost an extra Rs 5,000.

• Had it been levied on GST, the cess would have come to Rs 1,400 only.

• A car that costs Rs 10 lakh will now be dearer by 10,000. One that costs Rs 15 lakh will be an extra Rs 15,000.

• A TV that is priced Rs 50,000 now will be dearer by Rs 500.