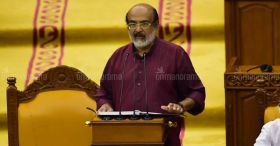

There are not many encouraging signs for a flood-devastated Kerala in the Economic Review 2018 tabled in the Assembly on Wednesday, on the eve of the 2019-20 Budget presentation. Own tax revenues are falling, debt stock is ballooning, and generous central transfers will stop. This is a clear warning that Kerala finance minister Thomas Isaac will not be keen on reducing deficits like he was last year. Fiscal consolidation will have to wait when the reconstruction of the state is on.

The Goods and Services Tax, which it was said would benefit a consumer state like Kerala hugely, has still not yielded desired results. The review is not cheered by marginal improvements, either. “The growth rate of own tax revenue (OTR) for 2016-17 was 8.16 per cent. It rose to 10.16 per cent in 2017-18. This indicates that the slowdown in growth rate of OTR since 2013-14 still continues,” the review said. The minister had taken charge of the finance portfolio in 2016 with the promise that he would push up tax growth to 20 per cent. The OTR growth rate, in short, has declined to an average of 10 per cent since 2013-14 when it was 18 per cent between 2006-07 and 2012-13.

Not just the OTR, even the total revenue receipts have shown an alarming decline. While the growth in the state's revenue receipts was a booming 22 per cent in 2011-12, it has in 2017-18 slumped to 9.8 per cent. After 2011-12, the big high came in 2015-16 when the growth rate was nearly 20 per cent.

Illusory spike in receipts

This 2015-16 spurt was slightly deceptive. It was mainly on account of a rise in the share of central taxes granted to states. It shot up from 32 per cent to 42 per cent. Besides, the state received a revenue deficit grant (money to help the state bridge its burgeoning deficit) that was spread over three fiscals: Rs 4640 crore (2015-16), Rs 3350 crore (2016-17), and Rs 1529 crore (2017-18). These substantial money transfers, which had kept the state going during the last three fiscals, will not be available from the 2019-20 fiscal on. The review was also of the opinion that the 15th Finance Commission recommendations for tax devolution would hurt socially advanced states like Kerala.

Compounding the woes is the fattening debt stock. In 2017-18, it is 30.68 per cent of the GSDP, up from 30.25 per cent in the previous 2016-17 fiscal. Not even a decade ago, in 2011-12 for instance, the debt-GSDP ratio was 24.56 per cent.

Silver lining

But it is not as alarming as it seems. Borrowings and liabilities as a proportion of revenue receipts, an indicator of debt stress, is steadily coming down. This ratio of interest payments to revenue receipts has been declining since 2014-15. The Comptroller and Auditor General report on state finances 2016-17 has also pointed this out. “Interest payments as a percentage of revenue receipt showed a decreasing trend during the last two years, which indicated that the state's interest liability was not growing with increase in debt liability,” the CAG report had said.

Holiday for fiscal tightening

Nonetheless, the review acknowledges that various external factors, including the August floods, have thwarted the state's fiscal consolidation efforts. And the review calls for a fiscal consolidation holiday at a time when the state is desperately trying to find its feet after a massive deluge. “Fiscal consolidation is the aim in the medium run, but when rebuilding the state is the most biggest priority, annual deficit targets need to be relaxed at least for a year,” the review noted.