An element of uncertainty has seeped into the global economy this year. Analysts have predicted bleak scenarios and some foresee a financial disaster in 2016.

The question is will it and when?

A slowdown in Chinese economy and the weakening of its currency, a slump in oil prices to levels below $30, shrinking global consumer demand and over-valued stock markets are the prime concerns the world economy is facing.

All these indicators seem to trigger more stock market speculation, and in the worst case, a financial meltdown.

But some economists do not paint such a dismal picture and definitely not the 2008 scenario, when global markets were roiled by the US mortgage crisis.

They do not rule out some kind of financial crash this year, but it could happen only if there is a political turmoil or a crisis similar to 2008.

In spite of these factors, the US economy, the world’s largest, is stable. There are no signs of a slowdown in the US.

Consumer demand is robust as oil prices dip. An average US consumer has more money to spend as his fuel bills come down.

The stock market woes were triggered when central bankers resorted to quantitative easing – money was flushed to banks to provide ample liquidity.

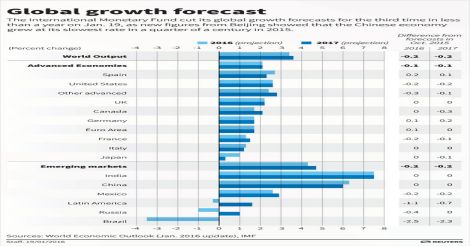

Global growth forecast. Graphics: Reuters

Global growth forecast. Graphics: ReutersHowever, these banks routed the money to speculate on the stock markets rather than to lend to fuel the economy, which was the primary aim of quantitative easing. This in itself indicates the stock markets might be over-valued.

Oil in a free fall

Unlike 2008, when sub-prime lending caused the housing collapse, this time the commodity market is under tremendous pressure.

Oil seems to be in a free fall, causing tremendous instability across the world. Many banks and financial institutions are speculating on commodities.

With Iran about to pump more crude into the market, there could be a further drop in oil prices. Oil producing companies are bound to feel the impact on their local economies across the Middle East.

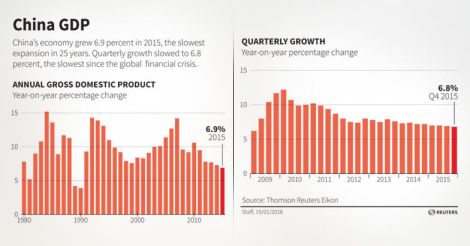

Graphical representation of China's GDP. Graphics: Reuters

Graphical representation of China's GDP. Graphics: ReutersThe Chinese economy grew 6.9 per cent last year, a little less than the official target of 7 per cent. This is the slowest economic growth in 25 years.

China is staring at two immediate issues.

First, the stock market in the country seems to be unstable.

The day after New Year, the Chinese market went on a free fall in spite of new regulations and circuit breakers meant to prevent such sudden crashes. China is supposed to have stopped the use of the circuit breaker.

Second, after almost two decades of double-digit growth in China, manufacturing and infrastructure seems to be in trouble.

Steel and cement prices are at an all-time low. For the first time, Chinese companies have laid off many workers.

There is tremendous overcapacity in manufacturing and companies have high levels of debt, which Chinese banks had funnelled cheaply to fuel the boom.

Many European countries that are already facing a slowdown might face added pressure when many of their exports to China slump.

Countries that provide raw materials to China will also be affected by a slowdown in the Asian giant's economy.

The Chinese government has cut interest rates and diverted funds to infrastructure projects to keep the economy moving.

However, China has added jobs in the service industry as well and has expanded to other areas years ago to diversify its economy from a manufacturing economy. This will certainly be a test for China and the world.

The stock market woes were triggered when central bankers resorted to quantitative easing – money was flushed to banks to provide ample liquidity. Photo: iStock

The stock market woes were triggered when central bankers resorted to quantitative easing – money was flushed to banks to provide ample liquidity. Photo: iStock

Disclaimer

The comments posted here/below/in the given space are not on behalf of Manorama. The person posting the comment will be in sole ownership of its responsibility. According to the central government's IT rules, obscene or offensive statement made against a person, religion, community or nation is a punishable offense, and legal action would be taken against people who indulge in such activities.