With KIIFB weakened, what's the Left alternative to boost capital and social spending?

Mail This Article

Since March 2022, the moment the Centre began its crack down on off-budget and extra-budgetary borrowings, the usefulness of Kerala Infrastructure Investment Fund Board (KIIFB) has been in question. As it stands, with its borrowings included in the State’s debt, there is no reason left to persist with KIIFB. After all, the investment mechanism was conceived to circumvent the Fiscal responsibility and Budget Management (FRBM) Act.

However, it also remains a fact that the KIIFB model has allowed Kerala to step up both is capital and social welfare spending in the last few years. On the one hand, KIIFB is investing heavily in non-'revenue generating' public infrastructure; on schools, hospitals, roads, power lines, IT parks, irrigation facilities, water resources and the like. And since this operates outside the budget, KIIFB frees scarce budgetary resources for social welfare. It seemed like a win-win situation.

Now, the Centre has pulled the plug on KIIFB. The LDF government is well within its rights to accuse the Centre of being discriminatory but it also has to ensure that Kerala's capital and social spending are sustained at high levels. A Plan B has to be in place.

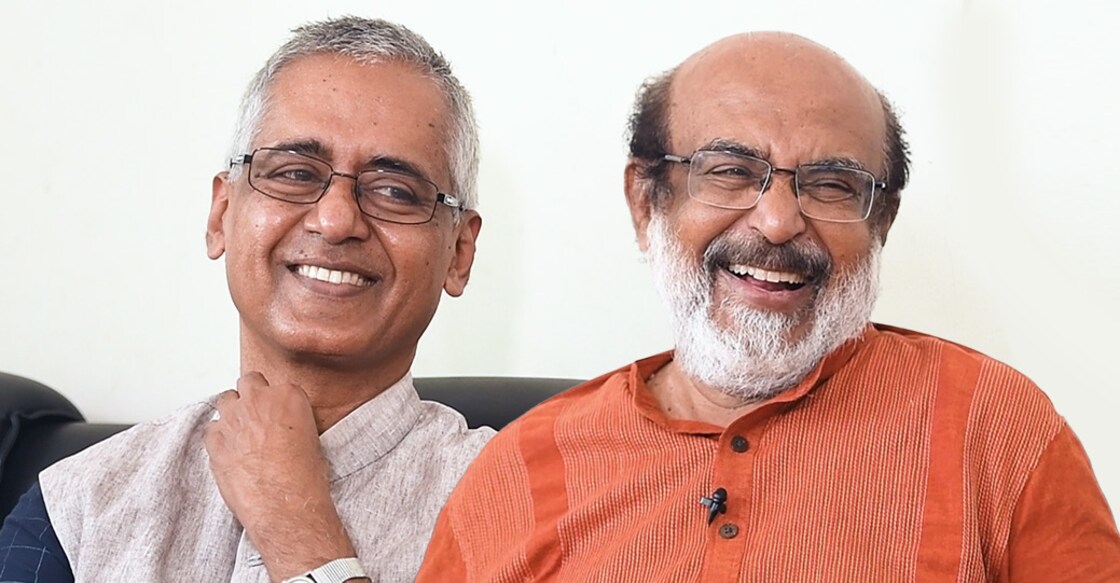

Former finance minister T M Thomas Isaac, the chief architect of the KIIFB model, is reluctant to speak of an alternative. "I am still sticking with the old plan. Because 2024 is a very important year. I look forward to see whether there will be a political change, a change of circumstances in which Kerala can bargain better," Isaac said during an Onmanorama pre-Budget discussion titled "KIIFB: Death of Left Altervative'.

However, top banker and one of Kerala's leading business and banking analysts S Adikesavan, even while conceding that the recent investment surge in Kerala would not have happened without KIIFB, proposed alternatives. "Now that a limit has been imposed, I think there are two or three alternatives," he said.

Interestingly, his first proposal is best implemented through KIIFB: Increased borrowings by municipal corporations. "These entities can raise funds for infra investment and even if the execution agency is KIIFB the repayment can come out of funds being raised by these entities so that it is seen as off-budget," Adikesavan said. In other words, the inflow into KIIFB will be from local bodies instead of from the State Budget in the form of half the annual motor vehicle tax and petrol cess and, as a result, the Centre cannot crib that KIIFB is using budgetary funds.

"I am thinking of a structuring of the repayment," Adikesavan elaborated. "The concern is because the repayment for KIIFB is coming from the budget. Now, the repayment will be coming from local bodies," he said.

Though Isaac's optimism that the BJP will be thrown out of power made him keep aside thoughts of a Plan B, the former finance minister was quick to second Adikesavan's proposal. "What he said is very much possible," Isaac said. "I didn't want to go into Plan B because still I want to stick with Plan A hoping that there would be a favourable political change. But now that he has raised this, this is precisely one method of approach," he said.

The local governments will play a greater role in infrastructure development, the former finance minister said. He said the 'local body'-powered KIIFB was a workable model. "We had the EMS Housing scheme by the local governments. It is possible for municipal entities to raise loans because they are assured of an income," he said and added: 'The first municipal corporation to undertake a borrowing in India was in the 60s, Kozhikode Municipality. That's a record. But then we completely forgot about this financing method."

There were two other alternatives recommended by Adikesavan to mobilise funds for infrastructure. One, a cess similar to calamity cess that even the GST Council had approved. "Can we not try for an infra cess on intra-state (not inter-state) GST where the people of the state will level. Whatever they pay we will use it for infrastructure borrowing repayment," he said.

Two, rationalise government expenditure.