This time around, the budget focused on industries hit by demonetization, but our lost businesses shall never be revived, says Unnikrishnan I, managing director of Yogakshemam Loans Limited.

“The real estate and small scale housing sectors will see a boom following this budget. The dip in the long-term capital entry rate from Rs 3 lakh to 2 lakh will ignite a tendency for active property trade. Obviously, the budget seeks to smooth the ruffled feathers of those segments of the society, which were brought to a standstill by demonetization,” he told Onmanorama.

Explaining how the union budget will benefit banking and non-banking sectors in the country, Unnikrishnan said that no magic can happen overnight and the lost businesses wouldn’t be compensated. “The five percent dip in income tax points to the increase in ledger data, and a better track kept at all cash transactions from the part of income tax. Compliance level will be more and this will in turn increase the lendable amount of money at banks,” he said. Finance sector will benefit from it as the possibilities for fund diversion narrows, he said, though the budget has nothing much for large corporates, entrepreneurs and businessmen.

Real estate sector was expected to face a huge break down after demonetization. But by bringing down the removable property's capital entry to Rs 2 lakh, the government has addressed the real estate crisis from both ends: one, small scale infrastructure sector will witness a boom with the advent of affordable housing plans; and two, the rate of real estate trades will increase as there is a very meager amount of payable tax if the property is held in hand for two years, said Unnikrishnan.

He expects this to make a change in common man's housing projects. Meanwhile, the focus given to poverty alleviation, rural economy and infrastructure shows an increased concern on the rural economy, spoiled by the cash crunch.

“There is almost zero income tax for people with income up to Rs 5 lakhs; this one is undoubtedly a layman-friendly budget,” he said.

Commenting on the loss demonetization caused to the non-banking sector, Unnikrishnan said that while the gold loan companies did not face a challenge, other sectors like micro finance, property loans and housing loans saw a rough patch in business.

“There were huge possibilities of fund diversion in rural finance sector due to the lack of authentic sources and other customer documents. The drive towards cashless economy can increase the compliance level in banking, which will encourage effective and controlled use of lendable proportion of money in banks,” he said.

“But this will not happen overnight. Small scale traders will take some time to fall in loop, but eventually, they cannot resist the need to comply with the larger system,” he added.

Unnikrishnan said that the public machinery spread false propaganda when it comes to the tax pattern in effect with cooperative societies. “The layman was convinced that the income tax system wasn't applicable to cooperative societies. This is purely due to the lack of political will. Increase in compliance level will help demolish such rigid structures of false propaganda,” he added.

“According to the income tax amendment of July 2016, it was clearly mentioned that all transactions above Rs 5 lakh should be done through banks. But this hasn't yet been complied by the registration department. All the public machinery should work together to increase this compliance level” he added.

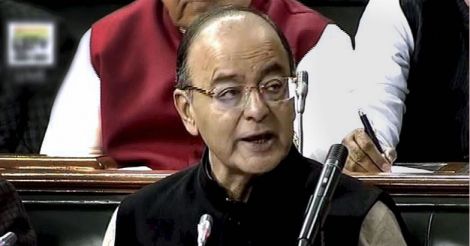

Finance Minister Arun Jaitley presented the union budget in Parliament on Wednesday

Finance Minister Arun Jaitley presented the union budget in Parliament on Wednesday