Our long-term physical health is largely a collective outcome of our health habits, with some input from our environment and genes. For example, those with bad health habits such as smoking are at greater risk of disease, while those who exercise regularly are more likely to be healthy.

Likewise, our long-term wealth too is an outcome of our wealth habits, which can either be good or bad. The objective of this article is to highlight a few good and bad wealth habits, and discuss some powerful concepts of investing—in simple language.

Isn’t a good monthly salary enough?

Some people confuse being rich with getting a big monthly salary after obtaining a college degree. In fact, being rich or wealthy has much more to do than that. Rich people are rich because they know how to manage money better than other people, and not because they spent more years in college.

Many educated people whom I know do not have a long-term financial goal. They do not know the definition of being rich. All that they seem to want is a large monthly income to buy expensive things.

This article is written from the point of view of average people like me living in India, who are self-made, believe in work ethic and in paying taxes. This is not meant for the super-rich or for wealthy entrepreneurs who habitually take huge financial risks.

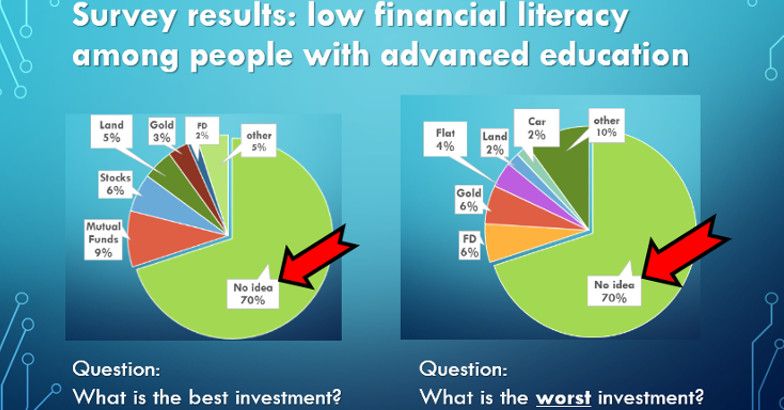

Educated does not mean financially literate: These are the results of a survey I did among my friends from various fields. It is noteworthy that the vast majority of highly educated people, each an expert in their own field, had very little idea about investing.

Educated does not mean financially literate: These are the results of a survey I did among my friends from various fields. It is noteworthy that the vast majority of highly educated people, each an expert in their own field, had very little idea about investing.

Definition of ‘Being Rich’.

My definition of being rich is the following:

“If you stopped working today, will your investments yield sufficient income to sustain your current lifestyle long-term, adjusting for inflation? In that case, you are rich”

Thus, being rich or wealthy is not just about our monthly salary. It is about reducing the monthly expenses and keeping money aside for investing.

In fact, if I was asked what we can change, I would say it is very difficult to increase one’s salary or daily wages without breaking one’s back. Besides, doing so will eat up all of our free time, which also means that we have no time left to enjoy our wealth.

It is a lot more practical to choose a less expensive, yet fulfilling lifestyle. Good wealth habits not only save us money that we can later invest, but also help us become financially independent earlier than other people.

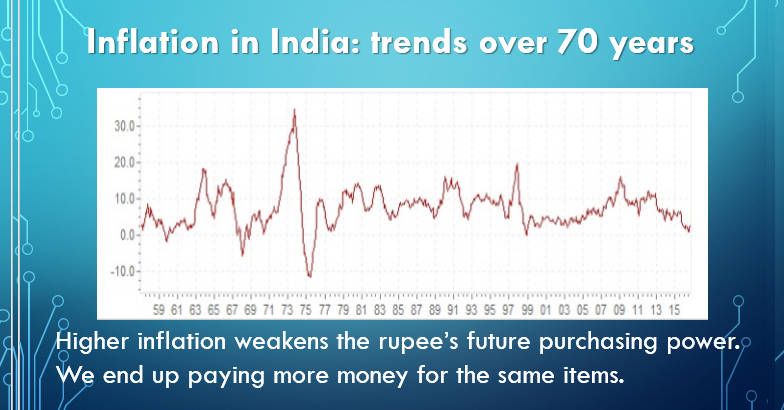

nflation reduces the purchasing power of currency in the future, while ignorance of a few basic things in finance can prevent us from reaching our true potential.

nflation reduces the purchasing power of currency in the future, while ignorance of a few basic things in finance can prevent us from reaching our true potential.

What is the difference between saving and investing?

Many people do not understand the difference between saving and investing. Saving is holding on to our money from unnecessary expenditures, while investing involves putting our saved money to work to generate more income from it.

I have divided the article into three sections:

1. Fundamentals of investing

2. Bad wealth habits

3. Good wealth habits

Fundamentals of investing

Why is it that savings alone will not be enough?

Scenario 1.

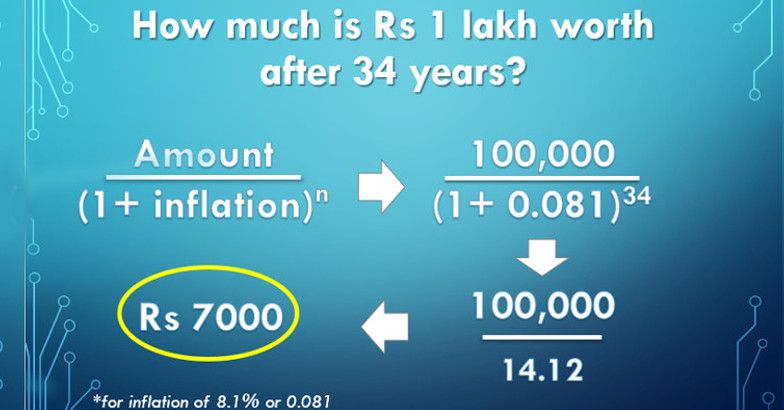

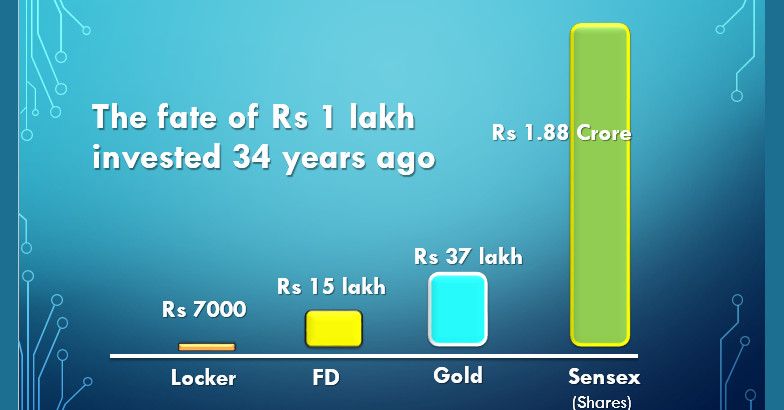

Let us imagine that we saved one lakh rupees and kept it in a locker for 34 years. When we open the locker after 34 years, it would have shrunk to Rs 7000!

How could that happen?

The answer is inflation, or diminishing value of currency with time. The true value of money is defined by its purchasing power. At the end of 34 years, the one lakh rupees can only purchase what Rs 7000 of today can (if inflation is 8%, see graph below). In other words, if we thought we had enough money to purchase a new car today, that same amount will only be enough to purchase the tyres at the end of 34 years.

Scenario 2.

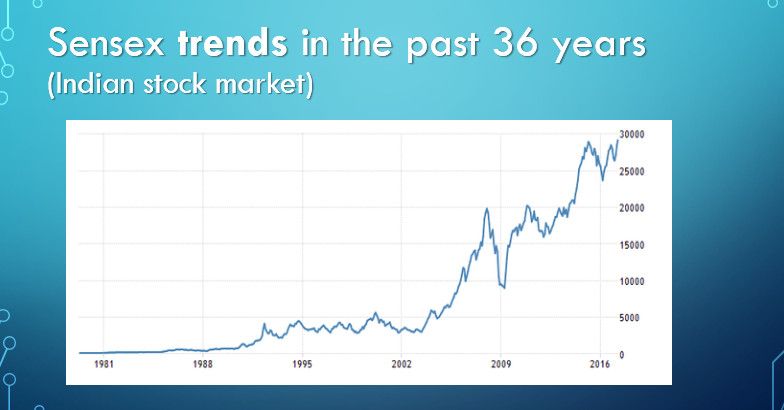

Now, instead of keeping in a locker, if we had invested the one lakh rupees in shares of reputed companies (those included in the Sensex) for 34 years, the amount would have multiplied to Rs.1.8 crore, which, at that point in the future, will have the purchasing power of Rs 13 lakh of today. Investing in land or gold also would have generated profits.

Impact of inflation on monthly expenses: why it is smart to reduce lifestyle costs.

Example 1

Remya and Manoj spend Rs 18,000 as monthly expenses in 2018. It will cost them Rs 2.5 lakh to maintain the same lifestyle after 34 years, assuming inflation of 8%. (If inflation rises to 10%, it will cost them Rs 4.6 lakh each month.) The question is whether their investments can generate such a large amount at that time, when salary would have dried up.

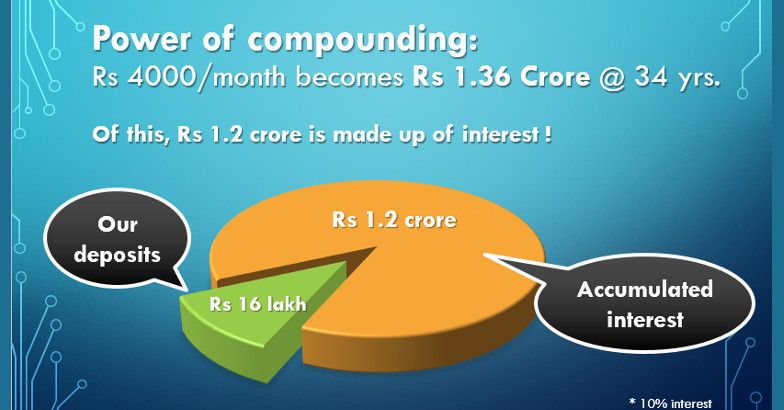

If they reduced the monthly expenses to Rs 14,000, then the monthly amount required after 34 years comes down to Rs 1.9 lakh. If the amount saved (Rs 4000) gets invested every month with a 10% interest, it will grow to Rs 1.36 crore after 34 years due to the power of compounding, which will be a good retirement corpus.

The surprising and almost unbelievable fact is that Rs 1.2 crore of this amount is accumulated interest, with their own deposits only amounting to 16 lakh rupees!

This is a simplified example to show the enormous long-term impact of keeping monthly expenses low while young.

What is ‘Power of Compounding’?

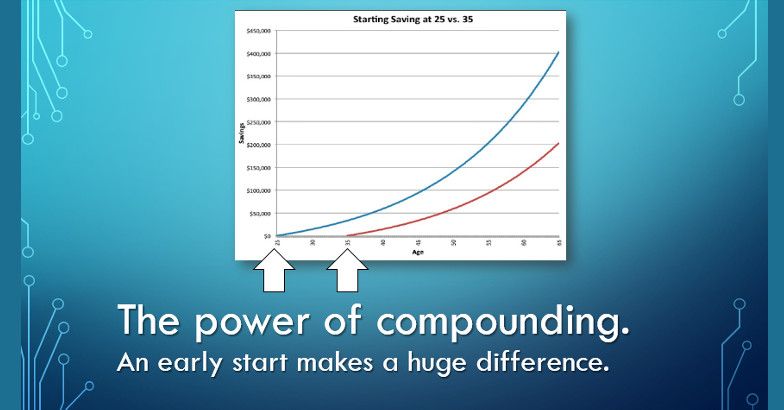

Unquestionably the most powerful principle of investing, it basically means that the earlier in life we start investing, the more our money grows. Albert Einstein called it the 8th wonder of the world.

Example 2

Ram started investing every year from the age of 20 till age 30, and then did nothing till age 57.

Shyam started 7 years later at age 27, but invested the same amount every year till he retired at age 57.

Both Ram and Shyam got identical payouts when they retired at age 57.

However, Ram’s money had multiplied 13 times, while Shyam’s multiplied only 4 times.

What was remarkable here is that Ram just sat and watched his early investments grow, while Shyam toiled away for 30 years. The difference is that Ram started investing at a younger age.

(*In this example, we used an FD interest rate of 8%. This also applies to other forms of investing including SIP’s)

Because of the power of compounding, time is the most powerful tool in investing. The earlier we start, the greater our returns are

Because of the power of compounding, time is the most powerful tool in investing. The earlier we start, the greater our returns areFor a salaried employee, what is the best way to invest?

Saving and investing are best done through an automated savings plan BEFORE it reaches us—as it is harder to give up money once we get hold of it. Only the minimum must be kept in savings account. Any excess can be parked in a liquid fund and then directed to one of the instruments listed below.

Ten popular investment tools that can utilise the power of compounding:

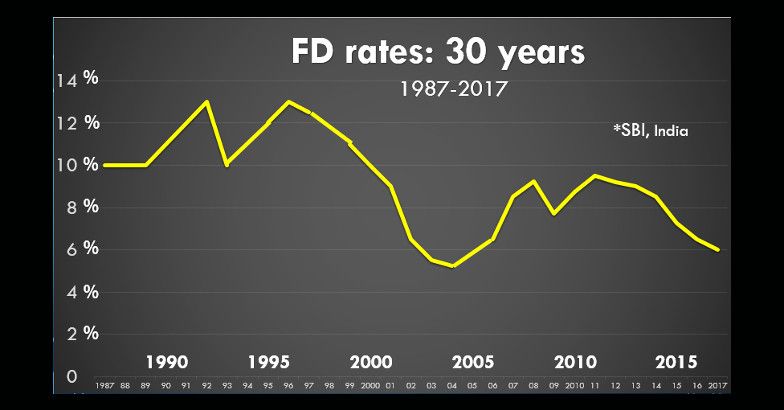

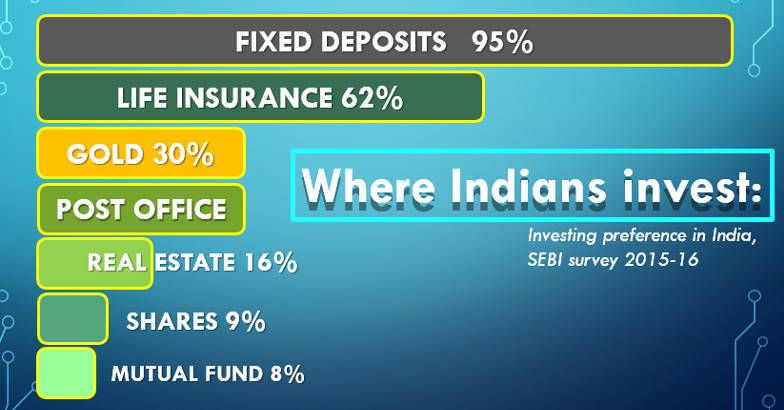

1. FD’s: There is low risk of loss of capital, a factor that makes it popular. Fluctuating interest rates and taxable interest income are the drawbacks of this traditional investment medium. The current bank FD interest rate of 6.5% becomes a mere 4.5% after income tax for those in the 30% tax bracket. Company FD’s give higher rates.

2. SIP in mutual funds: A mutual fund is a basket of stocks and bonds. The fund manager adjusts its portfolio according to market conditions. Equity-based funds invest in stocks and are of high risk and high expected return. Debt funds invest in bonds, treasury bills, and commercial papers and are low risk lower return. Balanced funds invest in both equity and debt instruments.

The fund has to be picked right to suit our financial goals, needs and investment style.

SIP’s or systematic investment plans facilitate regular investing into mutual funds of our choice. Instead of lumpsum investing, SIP’s invest smaller amounts at intervals. Thus, we are more likely to survive the ups and downs of the market—by a process called rupee-cost-averaging. Those who stop SIP when the market is down, lose a good opportunity to buy more units for the same price. The downside of SIP, which is seldom mentioned, is that along with risks, profits also diminish.

3. ELSS: Equity-linked savings schemes: tax friendly at both ends and easy to invest in, all of the money gets invested in mutual funds. Best held long-term, their drawbacks are that we can’t switch funds, and the money is locked away for 3 years.

4. ULIP: Unit-linked insurance Plans: Part of our money gets used to pay for our own insurance, and the remainder gets invested in mutual funds with a 5 year lock-in. Though tax friendly at both ends, the multiple charges, commissions and fees can diminish our returns.

5. NSC: National savings certificate: Gives better interest than FD, 80c compatible but interest gets taxed. Money is locked for 5-10 years.

6. Post office term deposit: Better returns than bank FD as 80c compatible and higher interest rate. No upper limit, but interest is taxable. Money is locked for 5 years.

7. Sukanya Samridhi and PPF (Public provident fund): Money is locked for 15 years, there is a deposit limit of Rs 1.5 Lakh a year, but have attractive interest and triple tax advantage (that is at investing, interest pay-out and at redemption).

8. Stocks (equity): When we buy a share, we are buying ownership in a company. Best held for the long-term, shares can generate revenue either by dividend pay-outs, or when we sell at a higher price. Suitable only for disciplined investors who are well-versed with the stock market or have reliable financial advisors.

The prospects of attractive tax-free returns prompts investors to ignore the inherent risk of losses. Risk can be minimised by buying only top-quality companies’ shares at a low price, such as those listed in the Nifty50; these are more likely to survive a crash than less-known stocks.

9. Bonds. A bond is essentially a loan we give out in return for interest. Bonds can be government or corporate, and are a fundamental part of every portfolio. Government savings bonds are safe investments that assure about 8% compoundable but taxable return, with a lock in of 6 years.

Tax-free Government bonds, when available, are popular long term tax-free investments, particularly for those in higher tax brackets. A tax-free bond at 6% gives an effective yield of 8.6% for someone in the 30% tax bracket.

10. NCD’s or non-convertible debentures are loans we give out to a company that wants to raise funds, in return for a more attractive interest than bonds. However, the interest is taxable. Secured NCD’s are backed up by assets, and are safer.

Tax matters:

Those who live and earn in a country must pay income tax by law. Smart tax planning however can help minimise our tax expenses. Unfortunately, many people are not savvy with taxes and lose a lot more money than needed.

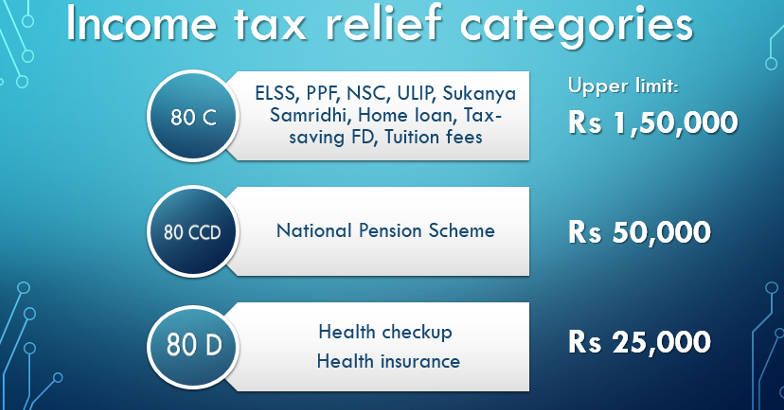

Savings taxes while investing is best approached from two opposite ends. The first is to maximise the investments that allow tax deduction, that is at the point of investing. The commonest such relief is the 80(c) deduction, into which we can invest a maximum of Rs. 1.5 lakhs every year. When we do that, taxes are calculated only for the remainder of our income.

One can choose from a variety of 80(c) compatible investments such as PPF, Tax-saving FD at scheduled banks, ELSS, Post office TD, ULIP’s, NABARD bonds, Sukanya Samridhi accounts etc.

What we must remember is that under 80c, only a total of Rs 1.5 lakh can be used for tax-saving purposes, any excess amount is not eligible even if we choose an investment vehicle from this list. Thus, 80 (c) allows a maximum tax relief of Rs 45,000 per year.

The other end, which is commonly ignored and merits more of our attention, is at the point of selling or redeeming our investments. Unlike bank interest from FD’s, retirement annuities, savings bonds and post office TD’s that get taxed at regular slab, some other forms of income are tax free.

A few examples of tax-free income:

a. Profits from sale of shares and equity funds after holding for at least one year, Sukanya Samridhi account, Tax-free bonds and PPF (Public provident fund).

b. Debt funds such as liquid funds only have minimal tax liability if held more than 3 years, thanks to indexation of capital gains tax.

c. Dividends from shares and equity-based mutual funds, up to Rs 10 lakh in a year. Dividends from debt funds are also tax-free for the investor.

d. Profit from sale of property is also income tax-friendly as long as it is used to purchase another property or bonds, with certain conditions.

All legitimate avenues of tax exemption must be discussed with the chartered accountant to maximise our tax savings. Being tax-savvy makes a huge difference not only during investing while younger, but also while choosing the right retirement income product for old age. For instance, many of the annuities (monthly payment plans after retirement) heavily promoted by banks and other large corporations incur income tax, which diminishes an already paltry pension.

In contrast, less publicised retirement alternatives such as systematic withdrawal plans (SWP’s) from mutual funds provide regular monthly income that is free from taxes, thus generating more juice out of our initial investment.

Being financially illiterate is therefore not an option. It could cost us dearly, more so when we are at our weakest—that is in old age.

6.Real estate decisions:

There is no doubt that purchasing land for a low price is a smart long-term investment idea, particularly in areas that have potential for future growth. There are several pitfalls however including disputes, litigation, encroachment and loss of liquidity. A discussion is beyond the scope of this article.

Property depreciation, low rent income and rising maintenance costs make apartments and houses less desirable investments unless 1) we plan to live in it for a long time or 2) we own it in high rental demand areas.

For those who are young and starting out, renting is cheaper than paying EMI for large houses. It makes sense to pay a small rent as long as we show the discipline to invest the rest systematically for a home purchase later.

Unlike a house that ties us down, renting allows us to move, upgrade or downgrade our living as the situation demands. For those youngsters who still want a roof over their heads, buying a smaller property is less risky than going for an expensive ‘dream home’ prematurely.

7. What about gold as an investment?

A metal that holds profound emotional and cultural appeal, gold can be purchased as jewellery, coins, bars or as gold ETF’s, gold mutual funds and sovereign gold bonds. Vanity aside, there is little debate that jewellery purchase is not a smart way to invest as its value diminishes the moment we take it home.

Sovereign gold bond issued by RBI is a paper alternative to physical gold purchase. A small interest of 2.75% per year gets paid, in addition to any appreciation in the price of gold. Bought in grams of gold, they are held for 8 years, and are extendable up to 11 years. Although the interest is taxable, there is no tax at redemption.

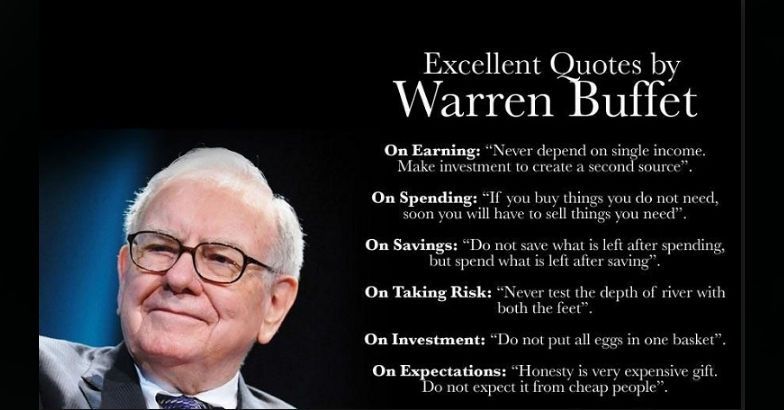

Many successful investors like Warren Buffet do not recommend gold as an investment option. Solid gold and paper gold can be part of asset diversification for those inclined.

8.Setting goals: intermediate and long-term.

No two portfolios are the same, as each person’s situation and needs are different.

Experts recommend creating investment portfolios with specific goals in mind, for instance if we wish to purchase a home in five years, pay for our child’s college education after ten years, marriage expenses in fifteen and retirement in 30 years.

Balancing expectation and risk, and diversifying our portfolio.

This is not an easy task—even for experts. But if we expect high returns, we must be willing to take some risks, which is easier said than done. For instance, real estate and stock markets have the potential to generate big profits albeit at greater risk, compared to the bond market or FD’s that are safer but with lower returns.

Many of those who made it big in these markets were just plain lucky to enter at the upstroke and exit before the crash. Notoriously unpredictable and cyclical, these markets have caused huge losses for several others too.

When the markets are doing well, we will be happy. But the question each one of us should honestly ask ourselves before investing in equity is, how we would feel if half our wealth was wiped out, and, importantly, how late in life we can safely absorb such a bump.

During the US stock market crash of 2008, many people saw their lifetime savings shrink to a fraction of the original size. Thus, putting all our money in stocks exposes us to the risk of losing our investment. Those who are unwilling to take risks are better off with non-equity based investments. Put another way, not losing money is also a part of wealth-building.

Asset diversification essentially means not putting all our eggs in one basket, and adjusting according to changing market conditions. When we diversify our investments, gains in some asset classes can help mitigate some of our losses in others. The downside of diversification is that poorly performing asset classes pull down our profits.

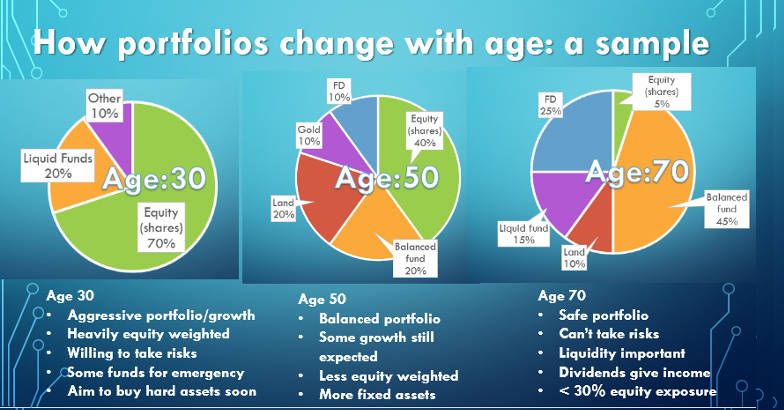

A suggested formula for the percentage to invest in stocks is (100-age). Stocks are generally preferred as long-term investments, and might lose money in the short term. Hence, they are better for younger people. For instance, a 30-year-old person can have (100-30) = 70% stocks in her portfolio, while a 65-year old who cannot tolerate high risk at that age would want to reduce equity exposure to (100-65) = 35%.

A detailed discussion of investing tools is not the purpose of this article. There are numerous choices that are best discussed with a financial planner who can suggest the right mix based on our age, income, liabilities, risk tolerance and investment style.

This is a sample to demonstrate how age affects asset allocation. There are no fixed rules here, much depends on the individual’s specific case.

This is a sample to demonstrate how age affects asset allocation. There are no fixed rules here, much depends on the individual’s specific case.

2.Bad Wealth Habits

1. Expecting steady income till retirement.

We can wish all we want, but the bitter truth is that the comfortable income we earn today might not come by so easily in the future. It is common for younger people with large salaries to fool themselves into thinking they are rich. Our future income could suffer for a variety of reasons beyond our control: changing market trends, lay-offs, ill health, outdated skillsets, new government policies, competition, outsourcing, disruptive technology, automation and artificial intelligence being just a few.

Rather than blow all disposable income on a lavish lifestyle and be caught shorthanded when crisis hits, smart people not only put money away, but also invest in upgrading their skills and knowledge to hedge such risks.

2.Living in a large house.

Many people build large houses hoping to impress other people, but are unaware of the permanent toll it takes on their monthly expenses. Unlike land, a house is a depreciating asset. Besides, after a few years, maintenance costs rise steeply.

Studies have shown that an increase of even 500 sq ft can increase our expenses by approximately Rs 30,00,000 over a 10-year horizon. I define a large house as 10% liveable space (where we spend most of our time) and 90% dead space. We end up spending a lot of money to decorate and maintain this large space.

Though I stayed in a large home abroad, now I live in a small house in India. Having done up my own room nicely, I feel comfortable in my personal space. To me, it creates the same satisfaction of living in a large home—this is just my perspective; obviously people have varying tastes and desires.

For those who believe a large house is a ‘good investment’, the question is: even if the house appreciates well, will they ever sell it (like a piece of land or shares) just because the price went up? On the positive side though, if ever the cash flow dries up after retirement, reverse mortgage is an option. This involves pledging the house to the bank in return for monthly payments.

3.Buying brand new luxury cars:

This is an area where a lot of people make financial blunders by letting ego override their logic.

The Rs 1 crore BMW story.

Ram and Shyam worked at an IT firm for ten years and earned a total salary of Rs 68 lakhs each. They paid Rs 20 lakh to the government as income tax and took Rs 47 lakh home.

Ram decided to invest in a mix of equity (80%) and debt (20%) instruments and got a conservative return of 12%, earning Rs 38 lakh after tax over the next five years, building a net worth of Rs 47+38= Rs 85 lakh.

Shyam decided to buy a brand-new BMW 320d. This German-made car is sold in other countries for Rs 22 lakh. When Shyam went to the showroom in India, he saw it had a price tag of Rs 37 lakh. After paying all the money he had—that is Rs 47 lakh (Rs 37 lakh plus Rs 10 lakh more to the government as charges and taxes), he got the keys and brought the car home.

While driving it for five years, Shyam had to pay Rs 30,000 every month for insurance, maintenance, parts and diesel. To do this, he worked hard, earned Rs 32 lakh, so that he could pay the government Rs 10 lakh of income tax and use the remaining Rs 20 lakh for these expenses—a lot of which eventually went back to the government as taxes.

Finally, Shyam sold the car for Rs 15 lakh. Since he was salaried, he could not claim tax relief on depreciation, which might have saved him about Rs 6 lakh.

Meanwhile, Ram also worked hard and earned Rs 30,000 per month. He invested this in equity @15%, generated Rs 30 lakh more in 5 years, increasing his net worth to Rs 85+30 = Rs.1.15 crore.

Thus, Shyam had to earn Rs 68+32 = 1 crore rupees to own the car for 5 years. In the end, Shyam had only Rs 15 lakh in his pocket. The government had taken away at least Rs 65 lakh from him as taxes. The remaining Rs 20 lakh went to BMW company and other car-related businesses.

Ram, on the other hand was richer by Rs 1 crore, with Rs 1.15 crore in his pocket. Ram did not believe in giving the government any more money than he was required to do, which was Rs 30 lakh.

It is quite clear that Shyam hadn’t sat down with this math before being tempted to purchase a brand-new luxury car. And, it only gets worse from there. Once we show the world that we own a luxury car, we are expected by society to buy a bigger car each time.

New luxury cars can be tempting, but are outrageously expensive to own in India. In the end the government is the winner, taking away over 65% of our earnings as taxes over a 5-year period. See story above for details.

New luxury cars can be tempting, but are outrageously expensive to own in India. In the end the government is the winner, taking away over 65% of our earnings as taxes over a 5-year period. See story above for details.While on that topic, let me disclose what car I own. I drive a second-hand, nearly new Volkswagen car that I picked up for half price. Driving a used car isn’t a bad thing at all in my opinion. I mean, don’t we stay in hotel rooms or dine with cutlery used by someone else?

In fact, I love it because I get the other guy (the first owner) to pay for the stiff taxes (20% in India now for higher segment cars) and also the immediate depreciation, which is precipitous.

4.Expensive weddings: Easily ranked among the worst financial blunders in the world, where enormous amounts of hard-earned money are flushed down the toilet—with no returns at all except perhaps for those in the wedding business.

Unsurprisingly, innumerable families in India suffer financial crisis due to the tradition of expensive weddings. One day’s expense can wipe out earnings of several decades, and even create debt. Why not have a frugal ceremony instead and invest the amount saved so that it will grow over time?

There is a big difference between a multimillionaire spending a tiny fraction of his earnings for his daughter’s wedding, and a person of average means spending the bulk of his life savings to show off a lavish wedding, although both are in the name of ‘social status’.

5. Expensive parties for every social occasion—because it costs a lot of money long-term. For the super-rich, though, it is a way of life, and for those in certain professions, it can be a part of conducting business.

6. Recreational shopping (shopping to kill boredom): a trend I had observed in the US, where people flock to the malls in the evening after work (mainly due to the lack of ideas on productive family time), now catching on in India. Unfulfilled desires get generated of owning the latest fashions on display, money gets reluctantly spent on kids’ games and expensive mall food; and a visit to the multiplex often follows.

7. Browsing through advertisements in the paper, TV, Radio or the internet. In the US, the Sunday paper is filled with fliers listing all the products available in local stores. To the average reader, this is akin to a virtual tour of the mall, creating new needs and wants, followed often by unwarranted and irrational spending.

8. Shopping at the supermarket while hungry. Unless we diligently stick to a shopping list, we frequently end up buying more than we need as a result of brain fatigue and poor decision making. This phenomenon was discussed in my earlier article on information overload.

9.Regular Drinking.

The number of men who drink regularly has gone up considerably in the past two decades. Apart from ill effects on health, drinking is an expensive habit. A person who drinks 2 pegs a day spends Rs 12-15,000 every month. If invested instead over 20 years, it would become Rs 1 crore or more. The indirect costs of drinking, specifically, the expenses of treating complications of alcohol use—can be enormous.

10.Investing in a business we know nothing about.

A high-risk behaviour that can cause enormous financial losses. Dishonesty is commoner than we think, and even people whom we initially trust can siphon off our income when we are not paying attention.

11.Being completely risk-averse. Not investing at all is a common mistake.

Because if we don’t invest, inflation will reduce our money’s purchasing power over the years, as described in the locker example.

12.Being too miserly.

Some people become so obsessed with saving money that they lead a miserable quality of life till they die. They fail to realise that money is like stored fuel. While having enough fuel for the future is important, it becomes valuable only at the point of burning it. The fate of the wealth that such people create, is frequently for other people to enjoy.

13. Wasting money on the wrong kind of insurance.

Insurance requirements vary depending on what stage in life we are at. For a young adult starting a career and family, buying the cheapest term life insurance for a fixed duration is a good option. After becoming financially independent, life insurance becomes less relevant.

Various products are available that claim to protect our family in the event of our untimely death. It is prudent to shop around for the best policy based on our needs, and not the company’s or the insurance agent’s needs.

We pay a lot less for term insurance than whole life insurance. If life insurance was a house, term life insurance is like paying rent as opposed to EMI to live in it. We can pay rent for as long as want to live in it, and for that we don’t have to buy the whole house.

Online term insurance plans cost much less than those sold by agents and brokers. For example, life insurance coverage for Rs 1 crore can cost us as little as Rs 8,000, or as much as Rs 6 lakhs per year.

14. Mixing insurance and investing:

Products that mix insurance and investing are best avoided; they are more transparent when purchased separately. Many naïve people however fall for the attractive buzzwords “mutual fund”, “assured pension” and “tax-saving” attached to such bundled products. Backed by big companies, such products often have emotionally appealing names, and are presented by a broker who might not tell us the unpleasant half of the story.

Unless we read the fine print, it is easy to miss the fact that instead of investing, much of our money is used to pay a large assortment of insurance fees and charges, which can dwarf the purported tax advantage (see section on tax below).

It is somewhat like giving someone Rs 1000 to deposit in our bank, but he first enjoys a meal for Rs 350, and then deposits the remaining Rs 650 in our name. We are better off doing depositing the Rs 1000 directly.

In my opinion, those interested in investing in mutual funds get more mileage by purchasing mutual fund units of their choice, rather than through such ‘packaged products’.

15. Not using our gadgets enough.

Buying expensive gadgets is one thing, while the utility we extract out of it is something else. A photography enthusiast who uses an expensive camera every day, gets more value out of it when compared to an also-ran who buys the same camera out of peer pressure and keeps it in the closet.

The same applies to expensive mobile phones. Those who use the advanced features of the phone over many years make more out of the money spent, compared to those who use it only to make phone calls and buy new models every other year. Other gadgets that become more expensive purchases by sitting idle include high-end coffee-makers that get forgotten soon after purchase, and treadmills, which frequently turn out to be a costly method of drying washed clothes.

A luxury car—particularly one that is used only on occasion—is the classic white elephant. Take the case of the family who uses their big Audi only to go to church on Sundays. If the car only does 3000 km per year, with a two-year decline in price upwards of Rs 30 lakh, the depreciation alone would cost the owner Rs 500 for every kilometre. If the church is located 10 km away from home, this works out to Rs 10,000 for each trip, excluding fuel and maintenance costs.

16. Using the yardstick of money to measure everything in life.

Unlike cars, stocks and real estate, there are some things that can’t be measured by money. For example, if we enjoy doing social work, gardening or photography as our hobby, it makes no sense when someone asks us “What do you gain from it monetarily?”

17. Being penny wise and pound foolish.

A common outcome of poor financial literacy, such people might bargain vigorously with the roadside vendor over the price of a guava, but will have no hesitation in wasting thousands of rupees in bad investments and impulsive purchases.

18. Fool’s advice.

Taking investment advice from pushy people who make commissions by selling their products isn’t a good idea. There is no free lunch. It is helpful to remember that their motivation is their own commission rather than our financial well-being.

The problem with ‘hot stock tips’ on TV and the internet is that it could be false news. Even if it were true, since it’s already been public knowledge by the time we hear it, the stock price would already have been adjusted.

It is better to be sceptical of the colleague who brags incessantly about his successful investments. For every stock that he claims he picked right, there will be several that he picked wrong and lost money on. Such people can mislead even disciplined investors to become gamblers.

The same applies to people who boast of huge gains in real estate and make others feel like losers. Nobody likes to talk about their own mistakes.

19.Day trading is like gambling.

For people without expertise, resource and discipline, day trading or buying and selling stocks rapidly is a guaranteed method of losing their investment. It also invites psychological stress, an unhealthy attribute.

20. Not knowing how banks work.

Many people forget the fact that banks and insurance companies are basically businesses that run by investing our money, giving us a small share of their profits in return. For instance, when we open an FD, the bank lends it out for higher interest than it pays us. The less we get, the more their profit is.

21. Not knowing how credit cards work.

Misleading terms such as ‘minimum balance’ tempt people to spend beyond their means. Minimum balance simply means the amount needed to avoid late fees. If the card is not paid in full in the billing cycle, we end up paying interest on the amount owed, which is how they make money.

22. Keeping large sums of money in checking/savings account

A common blunder. Every extra day that the amount stays there, we’ve lost another chance to make our own money work for us—while the bank would already have invested it for their own profit. If unsure of how to invest, the minimum that one can do is to move any surplus to liquid funds, which ensures both easy access and capital appreciation.

23.Comparing. The worst wealth habit, in my humble opinion, is this one—comparing our material possessions with that of others. Euphemistically referred to in the west as ‘Keeping up with the Jones’s, this habit, along with clever advertising, drives consumer markets world-wide, and creates vast wealth for several companies, especially those located in China.

A famous quote nails the issue: “Advertising is the art of convincing people to buy things they don’t need, using money they don’t have, to impress people they don’t like”

3. Good wealth Habits:

1. Improving our financial literacy. The more we know about the subject of finance, the less likely we are to commit blunders. The least that we should know is the difference between an asset and a liability, which is not always easy.

For instance, when we spend Rs 500 to attend a course in financial planning, it belongs to the asset column. But when we spend Rs 500 for a movie, it falls in the liability column.

Practically everything we do with our money can be classified accordingly; this takes some reading and practice. Financially savvy people constantly increase their assets, while minimising liability.

2. Self-improvement: focusing on areas in and outside of one’s professional expertise. Learning a few hobbies like photography, craft, gardening and art helps us create happiness without spending money each time. Learning to communicate and developing soft skills are important in every profession.

With science and technology advancing the way it is, it is now said that many of our skills become outdated by the time we get out of professional college. Mid-level managers who invest in upgrading their knowledge are less likely to be laid off as younger people take their place.

3. Children’s education: formal and informal: teaching them to think, rationalize, develop civic sense, showing them the basics of saving and investing.

An advanced college degree does not mean that we are financially savvy. Important things such as saving and investing need to be emphasised more in school and college, so that young people do not commit financial blunders early in their career.

An advanced college degree does not mean that we are financially savvy. Important things such as saving and investing need to be emphasised more in school and college, so that young people do not commit financial blunders early in their career.4. Being generous in giving money away to needy people, especially for their kids’ education.

5. Saving for retirement early in one’s career and investing the money.

6. Avoiding scams: holding on to our money and not falling for scams is perhaps as important as earning money. The number of seemingly smart people who fall for “Get rich quick” “Double your money” fly-by-night schemes is staggering.

Known as the world’s most successful investor, Mr Warren Buffet has always been a source of valuable investing advice. His net worth now stands at $ 83 Billion, that is Rs 53 followed by eleven zeroes. He has also shown by example why simple living is a key part of being wealthy. Mr Buffet still lives in an average middle-class home he bought in 1958 for $31,500 (Rs 1.5 Lakhs, per 1958 conversion rate), and drove an ordinary car for several years.

Known as the world’s most successful investor, Mr Warren Buffet has always been a source of valuable investing advice. His net worth now stands at $ 83 Billion, that is Rs 53 followed by eleven zeroes. He has also shown by example why simple living is a key part of being wealthy. Mr Buffet still lives in an average middle-class home he bought in 1958 for $31,500 (Rs 1.5 Lakhs, per 1958 conversion rate), and drove an ordinary car for several years.7. Knowing the difference between giving material gifts, experiences and time.

Increasingly more money is spent on the ritualistic giving of material gifts. Most of these create no lasting happiness, ending up as a piece of junk in an already overstuffed closet. Gifts of time and experiences bring more value in my opinion. For instance, spending quality time with a child is more meaningful than yet another toy.

The Wheel of Life is a great concept to manage our time and achieve balance in life. It can be customised. Finance is important, but it is only one spoke in the wheel. When all the spokes are equal, the wheel is able to run smoothly.

The Wheel of Life is a great concept to manage our time and achieve balance in life. It can be customised. Finance is important, but it is only one spoke in the wheel. When all the spokes are equal, the wheel is able to run smoothly.In summary, wealth is no doubt a necessity, and building it requires financial literacy and a clear plan of action.

More than our monthly salary, what matters is how smart we are in saving on taxes and making our own money work for us in the long term. Minimising liabilities and increasing assets is the key. Choosing a less extravagant lifestyle and avoiding social comparisons are important first steps in that direction.

Younger people must make an early start and utilise the power of compounding to generate big returns from small amounts of money kept aside. There is no perfect investment medium; each has pros and cons which change with time. Herd mentality and biased advice must be shunned.

Avoiding scams and bad decisions are part of wealth-building. As in the case of our health, one or two bad wealth habits can undo all the good created by a dozen good habits.

A doctor with his vast knowledge can give us better health advice than a colleague who might just know some medical jargon. Likewise, financial advice is best sought from an experienced and unbiased financial planner who can customize a plan based on our unique situation and preferences.

Further reading

1. Inflation-adjusted amount calculator

2. Compound interest calculator

3. Investments that qualify for income tax deduction under section 80c

5. An introduction to the 5 different asset classes.

6. When do we stop needing life insurance?

7. Information overload leads to poor decisions.