New Delhi: India said on Thursday it expected economic growth to surge above 8 per cent as it announced a 2018-19 budget that allocated billions of dollars for rural infrastructure and unveiled a health insurance programme for around 50 crore poor.

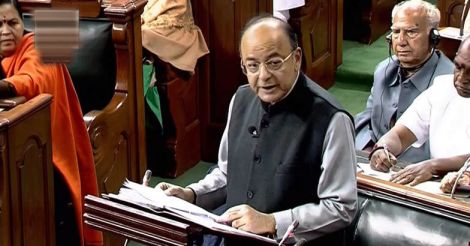

Highlights of finance minister Arun Jaitley's speech budget for the 2018-19 fiscal year.

For live updates, more news and analyses click here.

• No change in personal income tax rates for salaried class

• Standard deduction of Rs 40,000 for salaried employees in lieu of transport and medical expenses

• Customs duty increased on mobile phones from 15% to 20%

• For senior citizens, exemption of interest income on bank deposits raised to Rs 50,000

• 100% tax rebate for farmer-produce companies with a turnover of up to Rs 100 crore for five years

• Excess revenue collected from personal income tax Rs 90,000 crore

• 5 lakh WiFi hotspots to be set up in rural areas to provide easy Internet access

• All enterprises to have Aadhaar-like unique IDs

• 8 crore rural women to get free gas connection

• All trains to be provided with WiFi, CCTV and other state-of-the-art amenities

• Govt will contribute 12% of wages of new employees to EPF for first three years

• PF contribution for women reduced to 8% from 12% for first three years of employment

• Govt picks 99 cities for SmartCity plan; 10 cities to be developed as iconic tourist destinations

• 2 crore toilets in next two years

• National Highways exceeding 9000 km to be completed in 2018-19

• Rs 1,200 crore for wellness centers

• Railway university to be set up in Vadodara

• President, vice-president and governors to get salary hike – Rs 5 lakh, Rs 4 lakh and Rs 3.5 lakh, respectively

Fiscal deficit

• Fiscal deficit for 2017-18 seen at 3.5% of GDP

• Fiscal deficit for 2018/19 seen at 3.3% of GDP

• To use fiscal deficit target as key operational parameter for fiscal consolidation

Growth

• Estimates 7.2 to 7.5% GDP growth in second half of current fiscal year

• Finance minister says "firmly on path to achieve 8 percent plus growth soon"

Taxation

• To reduce corporate tax to 25% for companies who report turnover of up to Rs 2.5 billion

• Finance minister says "tax buoyancy more than expected, thanks to greater compliance"

• Proposes bringing listed entities under long term capital gains tax

• Long-term capital gains exceeding Rs 1,00,000 to be taxed at 10 %

• Proposes to raise import tax on mobile phones to 20 % from 15 %

• To raise health and education CESS to 4% from 3%

Expenditure

• Rs 1,48,528 crore capital expenditure for Indian Railways for 2018-19

• Rs 7,148 crore outlay for textile sector in 2018-19

• Rs 14.34 lakh crore to be spent for rural infrastructure

• Propose to raise institutional credit for agriculture to Rs 11 lakh Crore for 2018-19

• Rs 500 crore for Operation Green

• Agri-Market Development Fund with a corpus of 2000 crore to be set up for developing agricultural markets

Banking/lending

• To soon announce measures to address bad loans of small and medium enterprises

• Proposes setting up Rs 3 trillion plan for lending for small enterprises

• Reserve Bank of India Act being amended to provide the central bank with leeway to manage excess liquidity

Divestment/consolidation

• To merge government insurance companies into a single entity

• Finance minister says divestment target for 2017-18 has been exceeded, to reach Rs 1 lakh crore

• Divestment target for 2018/19 set at Rs 80,000 crore

Agriculture

• Finance minister says will focus on strengthening rural, agriculture economy

• Sets Rs 10 lakh crore to Rs 11 lakh crore credit for "agricultural activities"

• Minimum support price of all crops to be increased to at least 1.5 times of production cost

• Export of agriculture commodities to be liberalized

• To give 100% tax deduction for the first five years to companies registered as farmer producer companies with a turnover of 1 billion rupees and above

Gold

• To formulate a comprehensive gold policy

• To revamp gold monetization scheme

Health/pollution

• To provide Rs 5,00,000 per family annually for medical reimbursement under National Health Protection Scheme. Finance minister says the plan will protect 50 crore poor people and will be world's largest health protection scheme.

• To implement special schemes for governments around Delhi to address air pollution

• Removal of crop residue to be subsidized in order to tackle the problem of pollution due to burning of crop residue

What Modi said about budget

• Budget is farmer friendly, common man friendly, business friendly aur development friendly

• This budget will accelerate economic growth, it is focused on all sectors

• I congratulate the Finance Minister for the decision regarding Minimum Support Price. I am sure it will help the farmers tremendously

Read more on Union Budget 2018