Thiruvananthapuram: With revenue growth falling far off target and expenses running wild, Kerala finance minister T M Thomas Isaac tapped the only sources available to him - property registration fees and sales tax on alcoholic beverages.

The minister has set an ambitious target of raising Rs 970.40 crore from the little resources left at his disposal. He expects the Kerala Infrastructure Investment Board Fund to mobilize resources but he also has to keep the fiscal deficit under control to be able to borrow further.

Though the consumer state had expected to benefit from the Goods and Service Tax rollout, flimsy implementation has hurt the state’s revenue estimates.

Since the state is left with fewer taxation powers in the GST regime, Isaac’s first target was rather predictable. The increase in land tax will be a burden on all sections of society. The government, in effect, has reintroduced a tax mooted and scrapped by the previous United Democratic Front government. Isaac intends to raise about Rs 100 crore from the raised tax.

He has also increased the stamp duties on various financial transactions including land sale, partition deeds and gifts. Common man will be affected by the 5 per cent increase in fees for all government services.

The registration fees on all land deals were last revised seven years ago to Rs 1,000. Isaac raised the fee on transactions between family members from Rs 300 to Rs 600. The minister expects to raise an additional Rs 25 crore from these reforms.

The government also promised to increase the fair price on land by 10 percent to bring it closer to the market price. The government officers look at the fair price of the land to fix the registration fee on each deal. About 10 lakh cases of tax evasion on properties have been registered since the government fixed fair price on land in 2010.

The government estimates to generate revenue of about Rs 300 crore through the settlement of tax evasion cases between 1986 to March 2017. If the stamp duties are below Rs 5,000, the violators could regularize the deal and get away without paying a fine. In bigger deals, the violators could get the deals regularized after paying a fine equal to 30 percent of the shortfall in stamp duties.

In chit fund-related arbitration deals, the government would collect 2 percent of the arbitration amount as court fees. Citizens could continue to avail of certified copies of their land title deeds from the sub registrar offices for up to 10 pages. For every additional page, they will be required to pay Rs 5 each.

Stamp duties of 0.1 percent (subject to a cap of Rs 1 lakh) will be imposed on public works and other service contracts.

The big peg

The biggest weapon in Isaac’s kitty seems to be the sales tax on alcoholic beverages. The government has raised taxes on Indian-made foreign liquor even as it permitted the Kerala State Beverages Corporation to import booze.

Sales tax on Indian made foreign liquor brands that sell for up to Rs 400 will go up. Tax on such brands will be increased to 200 per cent from 125 per cent. Sales on pricier brands will go up to 210 per cent from 135 per cent. Sales tax on beer will be increased to 100 per cent from 70 percent.

Bevco officials said the increase is unlikely to make a major difference in MRP.

The state government is likely to keep taxes on imported liquor comparatively low because they are already subject to 150 per cent customs duty. Imported liquor will be taxed at 78 per cent and imported wine at 25 per cent.

The base price on imported liquor, excluding customs duty, will be fixed at Rs 6,000 per case to prevent the brands from undercutting the local counterparts. A case of imported wine will have a base price of Rs 3,000.

The government expects to raise Rs 60 crore from the plan.

Rev up revenue

The government has said that it would allow vehicle owners who had evaded road tax in Kerala to pay up before April 30. Isaac’s tone means that the government is serious about the violations this time. Any vehicle which has not paid the government its due will be seized from May, he said.

The government expects to raise Rs 100 crore from the tax evaders. The transport department has identified about 3,500 vehicles, including about 1,500 luxury vehicles, in Kerala who has illegally paid tax in Puducherry.

Meanwhile, the government has reduced the annual tax on electric, LPG and CNG auto rickshaws from Rs 500 to Rs 450. New vehicles will be required to pay Rs 2,000 for five years.

The government has increased the three-month tax on RLW tipper lorries by 3.5 per cent. The increase is expected to boost the government coffer by 8.4 crore but it could have a cascading effect on the construction industry.

The budget also includes a proposal to tax the non-transport vehicles registered in other states and servicing in Kerala for more than a month. They will be required to pay one-fifteenth of the 15-year tax paid by same-size vehicles registered in Kerala. The government expects to raise Rs 2 crore from the proposal.

There is another plan to seize vehicles that enter Kerala illegally from other states and impose double penalty on them.

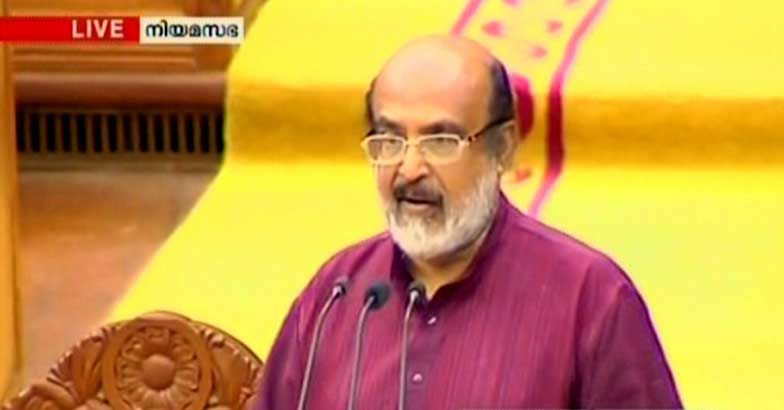

Thomas Isaac. Photo: Screengrab

Thomas Isaac. Photo: Screengrab