Finance minister Arun Jaitley in his 2018 Union Budget speech proposed several schemes for the poor and farmers. The last full Budget of the NDA government has been announced with an eye on the Lok Sabha elections due next year.

Understanding the Budget:

1. Fiscal deficit

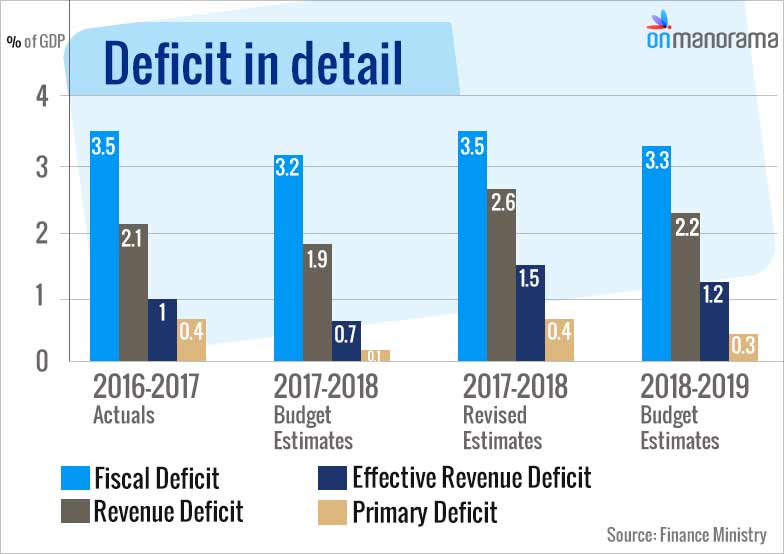

The government revised upwards its fiscal deficit target for 2017-18 to 3.5 per cent of the GDP, or the equivalent of Rs 5.9 lakh crore. It was pegged at 3.2 per cent of the GDP in Union Budget 2017. Fiscal deficit is a situation that arises when the government's total expenditure exceeds the revenue that it generates.

Even as the government corrected its last year's deficit estimates, for the financial year 2018-19, it has kept a slightly higher target of 3.3 per cent of GDP. The industry expectations this year was also for the government to stick to a 3.2 per cent. This led to slump in bonds, but experts are of the view that this won't sustain for long as the gap in the widening deficit is not too large.

2. What gets expensive and not

As Jaitley raised the customs duty on items including cars, motorcycles, mobile phones, fruit juices, and perfumes, these will be more expensive.

However, import duty on certain items such as raw cashew nuts, solar-tempered glass and cochlear implants were slashed. Hence, these items would be available at cheaper rates.

3. Income and expenditure

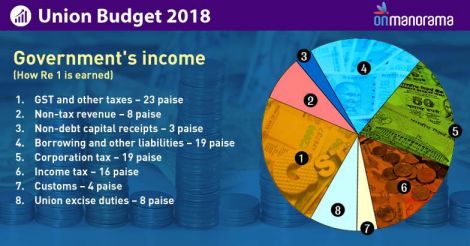

Though the government offered some tax sops to the salaried population, it plans to raise Rs 11,000 crore by increasing education and healthcare cess by a per cent. It also plans to raise money by imposing a 10 per cent Social Welfare Surcharge on imported goods. The primary education and higher education cess that existed earlier have been replaced with a single (health and education) cess at 4 per cent.

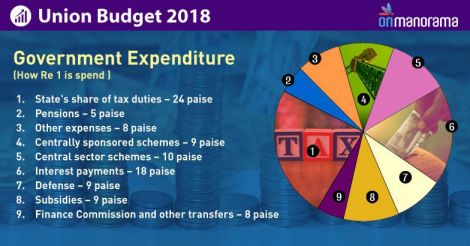

While the government decided to significantly increase its expenditure in the transport sector, other important sectors such as health, agriculture and education also saw increases.

The government earns most of its revenue from GST and corporate taxes, and a major share of it is earmarked for interest payments and in implementing the central schemes and programs.

4. Taxing the stock market

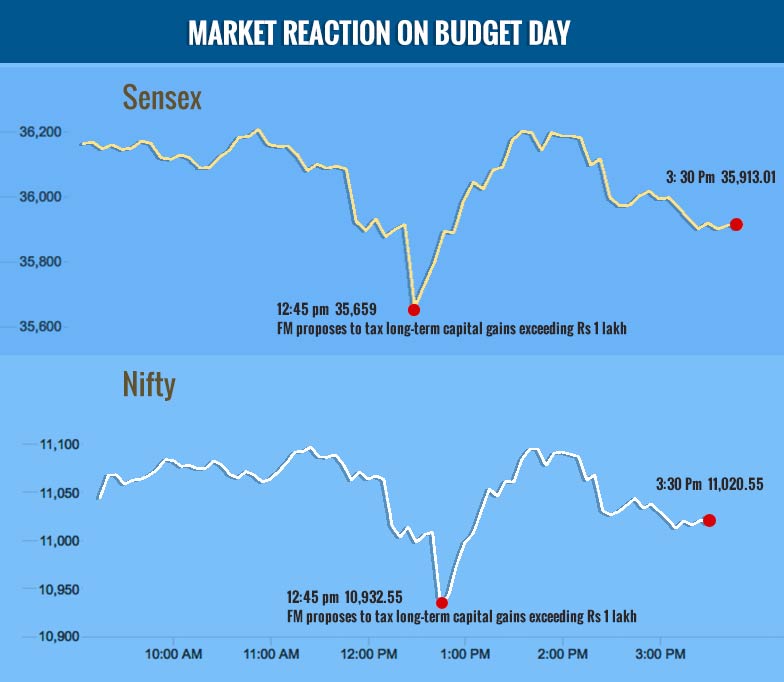

To increase the share of revenue, the government decided to tax the share-owning individuals. The tax exemption on long-term capital gains introduced by Manmohan Singh in 2004 was scrapped and gains over Rs 1 lakh will now be taxed at 10 per cent. The Center aims to raise over Rs 36,000 crore through this.

The stock market reacted sharply to this and started falling, with both Sensex and Nifty reaching a day's low of 35,659 and 10,932.55, respectively. Both the indices ended in the red even though they managed to regain slightly, banking on the sops announced for certain sectors such as agriculture and healthcare.

(With inputs from IANS; graphics by Sreekanth T V and Vinod A S)