Thiruvananthapuram: The Kerala government has just brought back a tax on land to tide over a financial crisis in the aftermath of the Goods and Services Tax (GST) rollout which took away most of the state’s taxation powers. Presenting the state Budget on Friday, finance minister T M Thomas Isaac said that the government proposed to reintroduce the tax which was scrapped three years ago due to a public outcry.

He also said that the government would weed out undeserving claimants of social security benefits from the list of beneficiaries. Anyone with an income of Rs 1 lakh, or who lived with anyone who paid income tax, would be out of the safety net. So will people who own a house bigger than 1,200 square feet, at least 2 acres of land or a car. The government, however, plans to start a participatory pension scheme for those who do not make the cut for the welfare pensions.

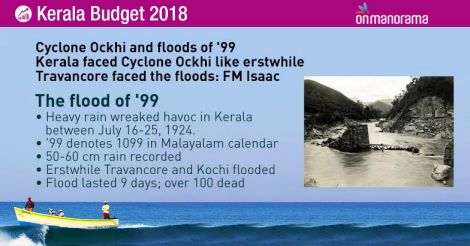

The Ockhi trail

Isaac started his Budget speech with a mention of the Cyclone Ockhi that devastated the fisheries sector of the state. He acknowledged that the sector still faced economic uncertainty. He announced a Rs 2,000 crore package for the development of coastal areas. He also promised Rs 100 crore to strengthen communication infrastructure and offered to set up free wi-fi areas along the coast.

The minister said that the government would strive to bring in Rs 900 crore of investment in the coastal areas through the Kerala Infrastructure Investment Fund Board (KIIFB).

The minister has allotted Rs 10 crore to prepare a detailed plan report of the development projects in the fisheries sector. The plan outlay for the sector was Rs 600 crore. The government intends to borrow Rs 584 crore to develop fishing harbors, Isaac said.

Hospitals in the coastal areas will be developed and a family health scheme unveiled. All schools along the coast will be included in an ambitious plan to be taken up by the education department.

A She Budget

Isaac presented a women-friendly Budget, which allocates around Rs 1,267 crore exclusively for women-centered schemes. This would amount to 13.6 per cent of total budgetary allocation.

Isaac has allocated Rs 50 crore for women safety apart from earmarking Rs 10 crore for all panchayats for women safety schemes.

The finance minister has also announced Rs 36 crore aid to assault survivors and Rs 5 crore to set up Nirbhaya houses.

To set up working women's hostel in all districts, the budget has set apart Rs 25 crore.

Reviving KSRTC

The government will not take over the Kerala State Transport Corporation’s (KSRTC) financial obligations but will seek to drive the state transporter back on the path of profitability through a complete restructuring of its operations, the finance minister said.

Isaac said the government would split KSRTC into three profit centers and bring changes at the management level.

The Budget has allocated Rs 1,000 crore for fiscal 2018-19 to reduce the difference in KSRTC’s income and expenditure.

The government will help the corporation get on its feet and pay salary and pension on its own, Isaac said.

KSRTC needs Rs 720 crore to pay pension alone, the finance minister said, adding that assuming this burden by the government alone would not solve its financial problems.

Schools to get a face-lift

Isaac has allotted Rs 33 crore for the digitization of the education sector. Friday’s budget includes a proposal to spend up to Rs 1 crore to modernize every school with at least 500 students.

The government has earmarked Rs 300 crore to set up computer labs and Rs 35 crore to elevate academic standards.

As much as Rs 54 crore has been allotted for special support for groups including the differently abled people. The government also promised to grant funds for the treatment and care of the differently abled. Special schools will get a face-lift with Rs 40 crore announced in the budget. BUDS schools will be set up in 26 more panchayats. As much as Rs 43 has been earmarked for the upgrade of existing schools.

Homes for everyone

The minister promised houses for everyone who owned a plot of land this year itself. As much as Rs 2,500 crore has been allotted for the Life housing project. A company will be formed to make loans available for the project.

Isaac said that the government would effectively implement a comprehensive social security scheme. The government would allot Rs 954 crore for food subsidies and Rs 34 crore for the food security project. Another Rs 250 crore will be spend for market intervention measures. SupplyCo outlets will be renewed using the Rs 8 crore fund. The government will exclude about 6 lakh people from the ration priority list because they were found to be undeserving.

The government also intends to promote poultry farming in a big way through people’s participation. Kudumbasree units will be encouraged to set up poultry farms in every panchayat. The state Poultry Development Corporation will be granted Rs 18 crore.

Revenue streams dry up

The finance minister painted a gloomy picture of the government finances. The state’s revenue growth stayed below 7.7 percent. The tax revenue up to November was below 6 percent, far off the target of 16 percent, he said.

He also said that the implementation of the Goods and Services Tax left much to be desired. He alleged that the center delayed the distribution of tax share to the states. The GST has helped only the corporates, not the people, he said.

He warned of strict austerity measures to tide over the financial crisis. The government will not allow the departments to let their budgetary allocations sit idle in the treasury. Expenditure will be kept tightly under control if the fiscal deficit kept ballooning. He said that he expected the fiscal deficit to reduce from 3.3 percent of GDP this year to 3.1 percent next year.

He said that the functioning of the KIIFB relied on the government’s fiscal discipline.

He said that Kerala was able to hold on to its prime position in economic achievements despite the propaganda of the communal forces.

Bevco outlets to stock up imported brands

The Kerala State Beverages Corporation (Bevco) has decided to sell imported liquor brands through its outlets even as the state government raised taxes on domestic brands including beer. The state-owned monopoly alcohol retailer opened the doors to foreign booze after it noticed that illegal trade in imported liquor was thriving in the state.

The Kerala government is likely to keep taxes on imported liquor comparatively low because they are already subject to 150 per cent customs duty. Imported liquor will be taxed at 78 per cent and imported wine at 25 per cent.

The base price on imported liquor, excluding customs duty, will be fixed at Rs 6,000 per case to prevent the brands from undercutting the local counterparts. A case of imported wine will have a base price of Rs 3,000.

Connoisseurs will have to wait though. The decision is not likely to be implemented anytime sooner because the government has to amend the rules and set up the necessary infrastructure before ushering in the foreign brands.

Read more: Kerala Budget | Will not assume KSRTC's obligations, says Isaac

Thomas Isaac presenting Budget 2018. Manoj Chemancheri

Thomas Isaac presenting Budget 2018. Manoj Chemancheri